During the last 100 years or so counties have operated beneath the idea that if property taxes (or in some circumstances water/sewer, and so on…) should not paid then the county can “take” the property for the unpaid taxes. A latest supreme courtroom ruling radically alters this idea and locations enormous liabilities on anybody shopping for tax liens. What’s the case about? Who gained/misplaced? What does this imply for people and cities/counties making an attempt to gather taxes? Do you have to purchase a tax lien after this ruling?

What was the tax lien supreme courtroom case about?

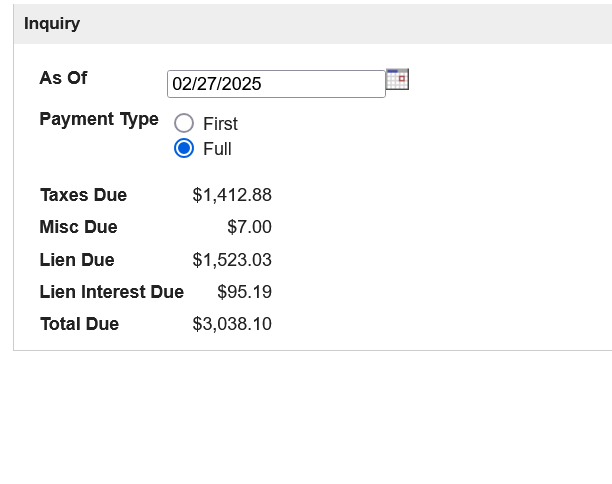

After 94-year-old Minnesota resident Geraldine Tyler didn’t pay property taxes on her former dwelling in Hennepin County, the County seized the property and bought it at public sale for $40,000. Although Tyler owed solely $15,000 in past-due taxes, curiosity, and prices to the County, pursuant to Minnesota regulation, the County retained the excess $25,000 from the sale quite than refunding it to Tyler.

Tyler filed swimsuit towards the County, arguing that by maintaining the additional $25,000, Hennepin County violated the Extreme Fines Clause of the Eighth Modification (amongst different constitutional provisions).

What did the supreme courtroom rule?

The Supreme courtroom guidelines unanimously in favor of Tyler that the county “took” her property

The Takings Clause, relevant to the States by means of the

Fourteenth Modification, gives that “personal property

[shall not] be taken for public use, with out simply compensa-

tion.” U. S. Const., Amdt. 5. States have lengthy imposed

taxes on property. Such taxes should not themselves a taking,

however are a mandated “contribution from people . . . for

the assist of the federal government . . . for which they obtain

compensation within the safety which authorities affords.”

Why are buyers liable for purchasing a tax deed?

The Courtroom reasoned that when a tax-certificate holder obtains a tax deed, they successfully “exercised a privilege created by the State in an effort to seize property.” The train of this privilege resulted in an amazing profit to the tax-deed holders, and even a windfall in some circumstances. So, the Courtroom reasoned that imposing the potential danger for paying simply compensation on the tax-certificate holder was applicable. In spite of everything, it was the tax-certificate holder who selected to pursue the deed-application course of as an alternative of submitting for conventional foreclosures.

Why is that this case so historic?

Previous to this case, counties had free reign to gather unpaid taxes, even when somebody owed simply 1 greenback on 1,000,000 greenback property, the county may acquire and finally an investor may take the property by means of a treasurer’s deed. This created a profitable marketplace for tax lien gross sales the place the county would promote its uncollected property taxes to buyers, instantly getting money and the investor would get a statutory price of return and probably the property if the tax lien was not redeemed.

What’s the new course of for tax liens?

At present in most states, when a purchaser purchases a tax lien, if the lien shouldn’t be paid inside x years, the tax lien purchaser can file for a trustee deed to the property. Based mostly on the latest ruling that is not allowed as a result of enormous legal responsibility to the tax lien purchaser. Now, in an effort to get a deed the county ought to provoke a foreclosures motion and any extra above the tax lien quantity should be returned to the proprietor (or different collectors). Lengthy and quick, the upside for tax lien patrons has been eradicated.

Ruling radically alters the economics of tax liens

Based mostly on the ruling by the Supreme courtroom, the complete economics of shopping for property tax liens has been eradicated. With the ruling there’s a danger for tax lien patrons and the upside potential has been eradicated. Let’s take a look at Colorado for instance, at this time the speed of return may very well be anyplace from 8% to fifteen% relying on whether or not somebody claims that there tax lien was improperly bought. Moreover, if the claimant is right, the tax purchaser may truly find yourself owing the claimant cash if courts discover that the fairness was “stripped” from the property as a result of a tax lien sale.

Ruling raises some enormous questions on tax liens going ahead

The implications of this ruling are far reaching and lift some attention-grabbing questions that can solely be resolved by means of case precedent going ahead.

- Chapter: Underneath the brand new paradigm from the ruling, to be protected the property must be bought through a foreclosures public sale. Foreclosures auctions will be stayed with a chapter and different instruments. On this case I imagine curiosity would cease accruing so the lienholder could be out for six months, a 12 months, or probably longer with no curiosity accruing. Moreover, who pays the charges to defend the lien (the county, lien purchaser, and so on..) and are these permitted to be added to the excellent quantity?

- Foreclosures prices: The tax lien course of could be very environment friendly at this time particularly for small quantities. With this ruling it seems each tax lien whatever the quantity should undergo and public sale course of earlier than redemption of the tax lien. This raises the query as to who pays. A sometimes foreclosures sale can run between 5-15k relying on the state (judicial, non-judicial, and so on…) and might take between 60 days and some years. Will the courts for instance permit a 10k payment for foreclosures prices on a lien that may have solely been 500 {dollars}?

Tax lien ruling creates enormous issues for Cities/Counties

Simply trying on the two questions above, that is the tip of the iceberg. The ruling creates enormous issues for counties. For instance, if patrons are not keen to purchase a tax lien, then the county is delayed in getting their cash to fund providers like Hearth, Police, faculties, and so on… There probably will likely be some proportion of tax liens which are not purchased as the danger reward shouldn’t be there. Moreover, counties are going to be spending a ton extra money on tax liens in the event that they must foreclose on each single tax lien in an effort to switch a deed. This may add appreciable money and time. Lengthy and quick, the ruling by the supreme courtroom may have monumental implications for counties and cities all through the nation.

Why you shouldn’t purchase property tax liens going ahead

Based mostly on this ruling, I’d be laborious pressed to even take into account shopping for a tax lien. Let’s assume to procure a tax lien for 2k on a property in Colorado, they don’t pay and curiosity is accrued. You file for a treasure’s deed after three years. To get a deed, the county should provoke a foreclosures public sale (takes 6-9 months in Colorado). Let’s assume the perfect case, you find yourself getting your funds again + the statutory curiosity as somebody bids out on the foreclosures. In essence you’ll make 10-12% return in your cash annually. Now, let’s take into account the draw back. That is assuming that the county goes to cowl the prices of the foreclosures and might add this quantity to the excellent steadiness; notice, I’m not satisfied that courts will permit this, and we are going to simply have to attend and see.

Now, assuming the identical situation above in Colorado, you file for the treasurer’s deed and the county initiates foreclosures. On the identical time the borrower declares chapter, so your curiosity stops accruing. Let’s assume the BK is dismissed, the borrower can then file chapter once more, particularly in very debtor pleasant states. Lengthy and quick this complete course of drags on for a 12 months or so, now let’s assume you had a ten% return in years one by means of 3, so 30% over the three years, with BK you are actually in 12 months 4 with no accrued curiosity. Now your annual return is about 7.5%, which is the very best case. This assumes that the courts allowed all the prices to be included on the tax lien and that the property truly sells for that quantity. Let’s now assume the property was a bit of land solely value 50k, the authorized charges added as much as 60k so that you are actually left with zero!

The above instance, though hypothetical for tax liens shouldn’t be actually hypothetical. We had a mortgage the place we made a 100k mortgage, the borrower bankrupted a number of occasions in a number of states that tied up the foreclosures for nearly 18 months and finally value over 60k in authorized charges. The situation above will occur on account of this ruling and the tax lien patrons are going to rapidly uncover the massive draw back danger to this funding.

Abstract

The tax lien ruling creates far reaching precedents for the complete nation. The brand new course of that should be applied because of this will exponentially elevate not solely the prices of perfecting a tax lien, but in addition raises questions of legal responsibility and return on funding. Counties are going to be put in a pinch as buyers refuse to purchase sure liens or probably any tax liens in any respect as a result of legal responsibility. Based mostly on this ruling, I’d be laborious pressed to even take into account shopping for a tax lien as your upside potential is eradicated and capped on the statutory rate of interest whereas on the flip aspect your draw back danger is big the place you lose your complete funding and probably worse than that the place you’re pressured to defend towards a legal responsibility declare. Lengthy and quick, be extraordinarily cautious and my private recommendation could be to not even take into account any funding in tax liens till there’s extra case precedent on legal responsibility.

Extra Studying/Sources

- https://www.theusconstitution.org/litigation/tyler-v-hennepin-county/#:~:textual content=Inpercent20Tylerpercent20v.,topercent20anypercent20percentE2percent80percent9Ccriminalpercent20behavior.%E2percent80percent9D

- https://www.supremecourt.gov/opinions/22pdf/22-166_8n59.pdf

- https://codes.findlaw.com/co/title-39-taxation/co-rev-st-sect-39-12-111.html

- https://www.gunnisoncounty.org/213/On-line-Tax-Lien-Sale

- https://www.fairviewlending.com/colorado-hard-money-loans/

- https://www.fairviewlending.com/the-largest-buyer-of-mortgages-predicts-big-changes-to-house-prices/

We’re a Personal/ Arduous Cash Lender funding in money!

Glen Weinberg personally writes these weekly actual property blogs primarily based on his actual property expertise as a lender and property proprietor. I’m not an armchair reporter/author. We’re an precise personal lender, lending our personal cash. We service our personal loans and personal industrial and residential actual property all through the nation.

My day job is and continues to be personal actual property lending/ laborious cash lending which allows me to have a singular perspective in the marketplace. I don’t settle for any paid sponsorships or advertisements on my weblog to make sure correct data. I’ve been penning this for nearly 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, fb, and different social media and ahead to your pals . I’d enormously respect it.

Fairview is a laborious cash lender specializing in personal cash loans / non-bank actual property loans in Georgia, Colorado, and Florida. We’re acknowledged within the business because the chief in laborious cash lending/ Personal Lending with no upfront charges or every other video games. We fund our personal loans and supply sincere solutions rapidly. Be taught extra about Arduous Cash Lending by means of our free Arduous Cash Information. To get began on a mortgage all we’d like is our easy one web page software (no upfront charges or different video games).

Written by Glen Weinberg, COO/ VP Fairview Industrial Lending. Glen has been printed as an skilled in laborious cash lending, actual property valuation, financing, and varied different actual property matters in Bloomberg, Businessweek ,the Colorado Actual Property Journal, Nationwide Affiliation of Realtors Journal, The Actual Deal actual property information, the CO Biz Journal, The Denver Put up, The Scotsman mortgage dealer information, Mortgage Skilled America and varied different nationwide publications.

Tags: Arduous Cash Lender, Personal lender, Denver laborious cash, Georgia laborious cash, Colorado laborious cash, Atlanta laborious cash, Florida laborious cash, Colorado personal lender, Georgia personal lender, Personal actual property loans, Arduous cash loans, Personal actual property mortgage, Arduous cash mortgage lender, residential laborious cash loans, industrial laborious cash loans, personal mortgage lender, personal actual property lender, residential laborious cash lender, industrial laborious cash lender, No doc actual property lender