Have you ever seen the viral video about Colorado ski actual property the place it predicts “total communities evaporating and the seemingly good city that has seen its median house value slashed by over 30% in simply 6 months”. How actual are these daring predictions? Trace, take a look at the record above from the video and determine two large crimson flags (take a look at cities I highlighted in yellow)? Do you have to be nervous a few “free fall” in Colorado ski cities? I’m going to dig into the claims with information to point out what is admittedly occurring in Colorado ski nation.

In regards to the viral video on the collapse in Colorado actual property

I used to be forwarded the video about 20 instances from associates in all of the mountain cities. When you haven’t seen it be at liberty to google it as I don’t wish to additional legitimize the data in it as it’s complete BS and fairly clear that whomever wrote it’s seemingly the identical individual that could be a Toron (vacationer who acts like a moron) that drives down I70 in a big truck in four wheel drive with mud tires pondering they’ll defy gravity solely to finish up within the ditch or worse.

What was within the video of the “free fall” in Colorado actual property?

Under is an excerpt of how the video begins, fairly ominous to say the least:

“ You see the photographs the pristine slopes the billion greenback resorts the right snow dusted essential streets you think about that cozy hearth in a multi-million greenback mountain house the last word escape the head of the american dream however that dream the one bought to hundreds of thousands is collapsing for the primary time in over a decade the colorado excessive nation is in a state of complete monetary freefall the pandemic fueled gold rush the zoomtown growth that noticed coastal elites preventing over log cabins is over and the hangover is extreme we aren’t speaking a few correction or a softening we’re speaking about an actual property catastrophe in the present day we’re not simply exhibiting you the gorgeous websites we’re taking you on a highway journey a monetary investigation by way of the ten mountain cities the place the market is cratering the toughest we’ll be counting down from 10 to 1 exposing the disaster because it will get worse and worse we’re speaking about value drops that appear like typos luxurious houses sitting empty for 400 days and an insurance coverage disaster that’s making properties essentially unownable this isn’t simply in regards to the rich it’s about total communities evaporating you’re going to be shocked whenever you see which seemingly good city has seen its median house value slashed by over 30% in simply 6 months and the primary spot it’s the one everybody believes is untouchable however the information we uncovered reveals a catastrophic collapse that native brokers are determined to cover”

3 preliminary crimson flags within the predictions of the free fall in Colorado ski actual property

Every time anybody makes massive daring predictions about an enormous rise or fall in something my BS antenna goes up and hopefully yours did as properly. Listed below are 3 obvious crimson flags once I noticed the record:

- 40% on the record aren’t even ski cities: Whenever you take a look at the record 4 of the ten cities aren’t even ski cities. Silverthorne and Edwards are principally suburbs of ski cities however no precise ski cities themselves. Moreover, Pagosa has a small ski resort about 30 miles away (Wolf Creek) and Durango additionally has a small ski resort (Purgatory) North of city however neither are ski cities, It might be like saying Boulder is a ski city resulting from its proximity to Boulder, or Evergreen is a ski city because it has Echo Mountain ski space. You’ll be able to ignore these 4 cities as they aren’t predictors of ski actual property as they aren’t really ski cities.

- Aspen and Telluride: Anybody who contains these two ski cities on a listing of worst actual property investments clearly has no clue about ski actual property. Aspen and Telluride are two of the highest actual property locations on the earth with completely zero stock. As anybody who has taken a primary economics class is aware of, when there may be demand and 0 stock costs keep about the identical or improve. There isn’t a approach both of those cities will “collapse” because the video claims. Any information the video cites about costs is complete BS. In Aspen and Telluride large gross sales can sway the info, for instance in a single quarter there may very well be a 150 million greenback sale (or a number of ones) and nothing in one other quarter. This doesn’t imply the market is unhealthy there may be simply too little information and big gross sales that make the info principally nugatory to make sweeping claims.

- Vail, Breckenridge, Steamboat, and Crested Butte: These are also a number of the high ski resorts on the earth with billions of {dollars} in Capital from Vail resorts and Alterra. Every of those cities additionally has little or no stock which is able to in the end put a ground underneath any value declines.

What does the info really say about ski actual property?

The numbers are giving a radically totally different reply. Check out this chart of all of the gross sales in Zillow till 10/31. Take a look at Steamboat and Vail, each have continued to extend. Moreover take a look at Crested Butte and Breckenridge, they’ve come off their highs, but I might be exhausting pressed to categorise both as a free fall

I wish to deal with 3 explicit resorts

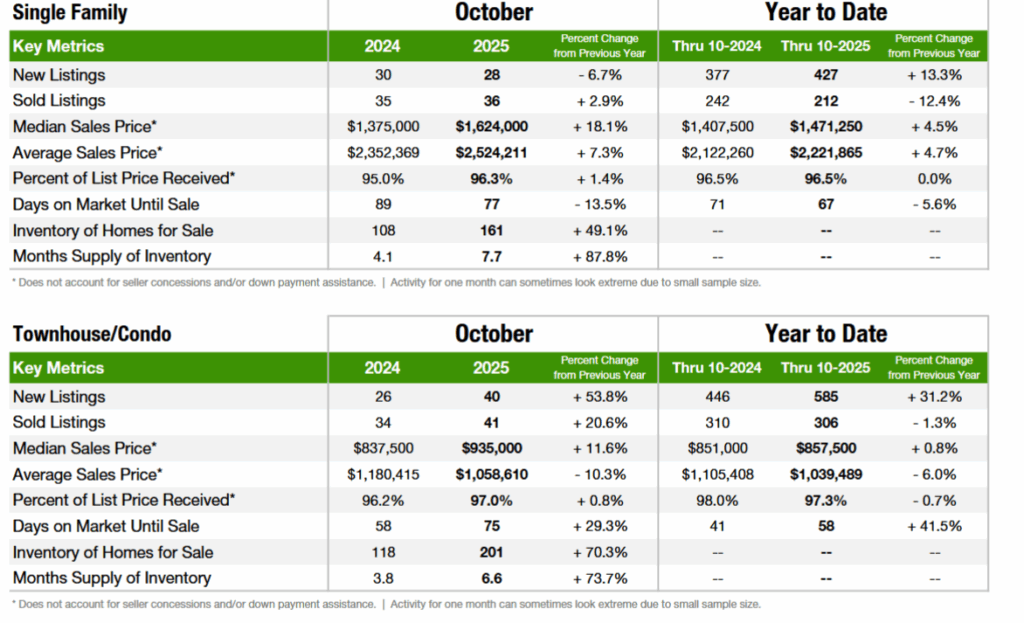

The information above clearly exhibits the claims on this video are complete BS. Under I’m going to go discuss just a little and present some extra stats on Steamboat (Routt County), Vail (Eagle County), and Breckenridge (Summit County). I pulled this information from the Colorado Affiliation of realtors to look extra in depth at these three markets. As talked about above it’s not attainable in Aspen and Telluride to make broad assumptions available on the market as they’ve large gross sales that sway the numbers significantly.

Is Steamboat Springs actual property in a free fall?

Homes nonetheless rising in worth, condos taking a minor hit on costs, massive jumps in stock that can in the end result in some value cuts, however no cliff drop

Is Vail actual property in a free fall?

Vail appears to be like fairly just like Steamboat with stock rising. We’re seeing common gross sales value improve, however median has come off just a little. There may be additionally some concern within the condominium market as costs decline and stock will increase

Is Breckenridge actual property in a free fall?

Breckenridge is fairly fascinating, stock is principally flat on each condos and homes whereas common costs have come off just a little. What this implies is that Breckenridge is beginning to come into higher stability.

Ski cities not in a free fall, however there shall be a correction

Though I’ve clearly proven that ski cities aren’t in a free fall, there may be trigger for concern.

- Stock rising considerably: In most cities we’re seeing a rise in stock which is able to in the end result in some value declines. You will need to observe in lots of cities like Steamboat, Vail, and particularly Telluride and Aspen the vast majority of houses had been purchased in money which alleviates fairly a bit of fireplace gross sales as there may be not the identical stress when carrying a mortgage.

- Condos struggling: Similar to within the metro markets, older excessive rise condos are underneath stress resulting from insurance coverage, inadequate reserves, and so on…

- Suburban markets to ski areas will get hit exhausting: I’m going to categorise a market like Silverthorne as a “suburban” market to the ski resorts however not really a ski city. These markets costs have elevated a lot that in lots of circumstances they’re approaching costs in most of the ski cities like Copper or Keystone, there shall be an enormous reset in costs within the suburban markets as costs are out of whack with actuality.

Observe, not one of the above gadgets are going to result in a cliff drop of a 60% decline in values within the core ski cities like Aspen, Telluride, Steamboat, Breckenridge, Vail, Crested Butte, and so on…

I’m nonetheless lending in each ski city in Colorado

I’m not a realtor making an attempt to promote you on a specific ski city. I’m a personal/exhausting cash lender. We lend our personal cash and maintain and repair all of our loans. On the finish of the day, I’ve the selection of the place to place my cash and I’m nonetheless doing loans in each single ski city. I simply closed loans in Breckenridge, Steamboat, Vail, and so on.. and I’ve dedicated on loans in a handful of different ski cities. I’m placing my cash the place my mouth is as long run I’m satisfied Colorado ski actual property continues to be an awesome funding.

Observe, anybody seeking to make a fast buck in ski actual property, these days are over as there may be going to be choppiness in Colorado ski actual property and actual property all through the nation, however long run Colorado ski actual property is exclusive in that there can by no means be anymore provide which is significantly going to restrict the draw back and guarantee there may be upside when the market recovers.

Video is a get up name to query the info

The constructive take away from this video is that hopefully it is going to be a get up name to query the info. It’s simple for folks to make daring claims like Colorado ski actual property will decline 60%, however the actuality is completely totally different. The numbers above from a number of sources (Zillow, the MLS, and my private data of every market) present a radically totally different story. Long run ski actual property continues to be a strong funding particularly within the main ski cities and elite ski cities like Aspen and Telluride. Please ahead/share this e-mail to assist set the file straight on what is definitely occurring within the mountain cities and join my publication to get this wonderful info in your e-mail each week 🙂

Further Studying/Sources:

https://www.fairviewlending.com/

https://www.zillow.com/home-values/14934/breckenridge-co/

We’re a Colorado Personal/ Exhausting Cash Lender funding in money!

I want your assist as my purpose in writing these articles is to supply the most effective info/perception on Colorado Actual Property that you just can not get anyplace else! Please like and share my articles on linked in, twitter, fb, and different social media and ahead to your folks/associates I might significantly recognize it.

Glen Weinberg personally writes these weekly actual property blogs primarily based on his actual property expertise as a lender and property proprietor. He’s the proprietor of Fairview Business Lending. Glen has been printed as an professional in exhausting cash lending, actual property valuation, financing, and numerous different actual property subjects in Bloomberg, Businessweek ,the Colorado Actual Property Journal, Nationwide Affiliation of Realtors Journal, The Actual Deal actual property information, the CO Biz Journal, The Denver Publish, The Scotsman mortgage dealer information, Mortgage Skilled America and numerous different nationwide publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and providers loans in Colorado which gives a novel actual property potential of what’s really occurring on the bottom each in Denver and all through Colorado. My purpose of this actual property weblog is to supply an trustworthy evaluation of what I see occurring in Colorado actual property and the way it will influence actual property homeowners, patrons, realtors, mortgage professionals, and so on…

Fairview is the acknowledged chief in Colorado Exhausting Cash and Colorado personal lending specializing in residential funding properties and industrial properties each in Denver and all through the state. We’re the Colorado consultants having closed hundreds of loans all through the Entrance vary, Western slope, resort communities, and in every single place in between. We additionally dwell, work, and play within the mountains all through Colorado and perceive the intricacies of every market.

Whenever you name you’ll converse on to the choice makers and get an trustworthy reply rapidly. We’re acknowledged within the trade because the chief in Colorado exhausting cash lending with no upfront charges or every other video games. Study extra about Exhausting Cash Lending by way of our free Exhausting Cash Information. To get began on a mortgage all we want is our easy one web page utility (no upfront charges or different video games)

Tags: Denver exhausting cash, Denver Colorado exhausting cash lender, Colorado exhausting cash, Colorado personal lender, Denver personal lender, Colorado ski lender, Colorado actual property tendencies, Colorado actual property costs, Personal actual property loans, Exhausting cash loans, Personal actual property mortgage, Exhausting cash mortgage lender, Exhausting cash mortgage lender, residential exhausting cash loans, industrial exhausting cash loans, personal mortgage lender, Exhausting Cash Lender, Personal lender, personal actual property lender, residential exhausting cash lender, industrial exhausting cash lender, No doc actual property lender