The pandemic turned the actual property market the other way up with actual property values surging all through the nation. With values rising in every single place, everybody appeared like a winner. Sadly, the growth city days are coming to an finish. Actual Property fundamentals or lack thereof will outline the winners and losers on this cycle. Listed here are three traits that may affect the winners in 2026. What would be the most secure actual property bets within the years to come back?

Three traits to information your investing in 2026 and past

Fundamentals in actual property would be the decider of winners and losers as we transition to a brand new part within the pandemic. The previous winners won’t carry out on this cycle. Peloton was a darling through the pandemic, and now it’s down considerably; this can be a warning to actual property homeowners/buyers that every little thing doesn’t at all times go up. The pandemic modified individuals’s attitudes in the direction of work, play, and household. Listed here are three traits that may affect the winners within the subsequent cycle.

- Household: US start charges have been already falling earlier than the pandemic, now they’re the bottom in 50 years to 1.64 for every lady (down from 3.65). With much less youngsters, the quantity of area and site are altered.

- Work: Previous traits arduous to interrupt. Enterprise journey and again to workplace will proceed to realize steam. Delta is forecasting large demand for enterprise journey. This leads us to the query, if enterprise journey goes to roar again, who’re the vacationers visiting? Others within the workplace! I don’t foresee the place all of the enterprise conferences will now happen in pajamas in a basement residence workplace. With enterprise journey coming again and workplaces transitioning to extra normalization, worker location will come into play. In case you now have to return within the workplace, it isn’t possible to reside 100 miles from the workplace. Word, this pattern was supercharged in 25 and can proceed in 26 because the unemployment charge continues to rise and companies proceed to realize leverage.

- Play: Millennials largest cohort of debtors making up 37% of all purchases, many of those youthful patrons are childless. With a youthful cohort of patrons, they may coalesce round areas which have the facilities they want: eating places, nightlife, comparable age cohorts, and so on… that are sometimes discovered in additional city areas. Word some cities will come again sturdy, whereas others will languish because the demand strikes to city areas simply outdoors town core. A very good instance is Cherry Creek in Denver that’s thriving versus areas in downtown Denver which might be struggling.

How are the three traits above going to form actual property values going ahead:

Delta Airways CEO of their latest earnings name mentioned: “Once we get to spring and summer season, we’ll see a sturdy demand for enterprise and client journey,”. Delta is anticipating this surge in demand by rising hiring and aircraft capability. On the flip facet, Peloton shares have plummeted as buyers play the reopening commerce. Work continues to “normalize” in 2026 whereas low start charges will proceed, and Millennials will proceed to be the biggest patrons within the housing market. How does this affect the place it’s best to spend money on actual property?

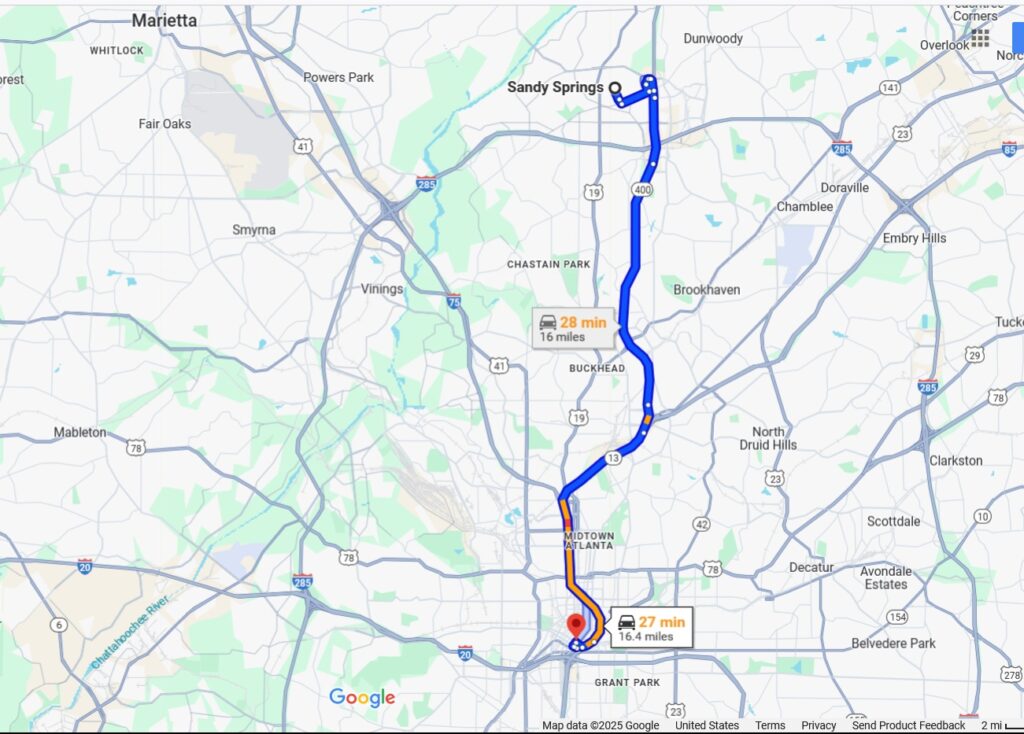

- Cities and Suburbs will come again albeit a bit otherwise. All three long run traits level to a reemergence of cities however the profitable cities and locations inside cities will little completely different. For instance, you might be seeing a decline in inhabitants in older cities like Chicago which might be migrating to “youthful” cities like Nashville, Atlanta, Miami, Salt Lake Metropolis, and so on… All of the predictions in regards to the mass exodus from cities are overblown as baby start charges and millennials are the drivers within the subsequent cycle. Moreover, patrons will migrate nearer to work which is often within the extra city areas. This may profit nearer in Suburban areas probably the most as that is additionally the place many companies are relocating to. Consider Atlanta, a sizzling space is Sandy Springs which is about 15 miles from Downtown. These would be the hottest areas as actual property transitions to extra normalcy.

- Outlying suburbs/ex urbs have peaked: The suburbs 50+ miles away from the massive employment zones will wrestle. As again to work occurs and the economic system normalizes it isn’t possible for many to commute 2 hours a day. These areas will not be the new areas.

- Far out rural areas will wrestle: The far-out rural areas are already previous their peak. Don’t get me unsuitable some that moved out of the cities won’t come again, however the overwhelming majority can be drawn nearer into the extra city areas as work and play are as soon as once more centered in lots of of those areas.

2026 can be difficult for actual property

Search for volumes to proceed at traditionally low ranges in 26 because the market continues to regulate to the brand new regular of upper rates of interest and the top of free authorities cash. 2026 can be much like 25 with values declining reasonably in some markets whereas others maintain higher. The actual story can be declining volumes that may proceed to harm the trade from realtors, title firms, attorneys, and so on..

2026 will start to disclose the true market fundamentals as the actual property feast the place every little thing goes up with 4 partitions is over. Patrons and lenders will proceed to be very cautious out there as there may be extra draw back threat than upside in lots of areas.

2026 will see some alternatives as there can be some stress out there. It won’t be a 2008 redo, however there can be some substantial alternatives in essentially sturdy areas. In abstract, the sky isn’t falling on actual property, however 2026 is setting as much as be a difficult yr with some large winners and losers. My recommendation could be to decrease your leverage so that you’ve the flexibility to reap the benefits of alternatives as they current themselves as 2026 will proceed the shake out of weaker property homeowners/markets.

Extra Studying/Assets:

https://www.fairviewlending.com/the-largest-buyer-of-mortgages-predicts-big-changes-to-house-prices/

https://www.fairviewlending.com/2025-real-estate-predictions/

https://www.cnbc.com/2022/01/13/what-delta-air-lines-predicts-for-business-travel-after-omicron.html

Millennials Account for 37% of Homebuyers, Over 50% of New Mortgages | The Ascent (idiot.com)

We’re a Non-public/ Laborious Cash Lender funding in money!

Glen Weinberg personally writes these weekly actual property blogs primarily based on his actual property expertise as a lender and property proprietor. I’m not an armchair reporter/author. We’re an precise non-public lender, lending our personal cash. We service our personal loans and personal industrial and residential actual property all through the nation.

My day job is and continues to be non-public actual property lending/ arduous cash lending which allows me to have a singular perspective available on the market. I don’t settle for any paid sponsorships or adverts on my weblog to make sure correct data. I’ve been penning this for nearly 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, fb, and different social media and ahead to your mates 😊. I’d tremendously admire it.

Fairview is a arduous cash lender specializing in non-public cash loans / non-bank actual property loans in Georgia, Colorado, and Florida. We’re acknowledged within the trade because the chief in arduous cash lending/ Non-public Lending with no upfront charges or another video games. We fund our personal loans and supply trustworthy solutions shortly. Study extra about Laborious Cash Lending by way of our free Laborious Cash Information. To get began on a mortgage all we want is our easy one web page utility (no upfront charges or different video games). Study the best way to discover a respected arduous cash lender and why Fairview is the finest arduous cash lender for buyers.

Written by Glen Weinberg, COO/ VP Fairview Business Lending. Glen has been revealed as an skilled in arduous cash lending, actual property valuation, financing, and varied different actual property matters in Bloomberg, Businessweek ,the Colorado Actual Property Journal, Nationwide Affiliation of Realtors Journal, The Actual Deal actual property information, the CO Biz Journal, The Denver Submit, The Scotsman mortgage dealer information, Mortgage Skilled America and varied different nationwide publications.

Tags: Laborious Cash Lender, Non-public lender, Denver arduous cash, Georgia arduous cash, Colorado arduous cash, Atlanta arduous cash, Florida arduous cash, Colorado non-public lender, Georgia non-public lender, Non-public actual property loans, Laborious cash loans, Non-public actual property mortgage, Laborious cash mortgage lender, residential arduous cash loans, industrial arduous cash loans, non-public mortgage lender, non-public actual property lender, residential arduous cash lender, industrial arduous cash lender, No doc actual property lender