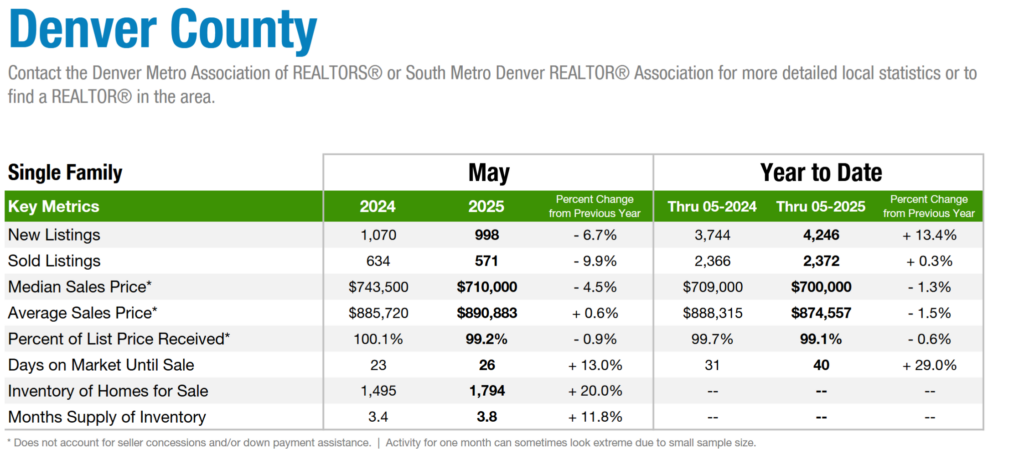

Take a look at Could statistics for Denver. With the surge in stock I’d have anticipated a pointy drop in costs, but median and common gross sales worth have barely budged. Now have a look at the chart beneath, what do you discover? Why are costs growing even with a rise in stock? What different variable do we have to watch? What do these two charts say concerning the energy of the Denver actual property market?

Stock surges in Could after which declines

Now have a look at the chart above of October, stock really declined even whereas bought listings additionally declined. How can this be attainable? This leads us to the third variable “delistings”. Primarily consumers that didn’t promote their property simply pulled the property off the market which exhibits a decline in stock in October.

What’s within the knowledge on delistings in Denver?

Delistings in October jumped almost 38% in contrast with a yr earlier, once more surpassing stock progress, in line with the November 2025 month-to-month housing traits report from Realtor.com®. Yr to this point, delistings have been up roughly 45% from the identical interval in 2024.

Since June, about 6% of listings have been faraway from the market by sellers every month, cementing 2025 because the yr with the best nationwide delisting price since Realtor.com started monitoring this metric in 2022.

What cities have the best Delistings?

As in prior months, delistings stay most typical in pandemic-era boomtowns concentrated within the inventory-rich South and West, the place costs have been falling.

- Miami stood out for having the best ratio of delistings to new listings, at 45, down from 60 in August however up from 34 in October 2024.

- Denver took silver with 39 delistings per 100 new listings, up from 37 in August and 24 yr over yr.

- Houston adopted with a ratio of 37 per 100, down from 40 in August however up from 31 in contrast with the identical interval final yr.

Is delisting a optimistic for the Denver actual property market?

When studying the article, it undoubtedly had a adverse tone about delistings: “The delisting pattern is an ideal personification of the stagnant and frustration-filled housing market,” says Realtor.com senior economist Jake Krimmel.

Paradoxically Delisting is perhaps an excellent signal for Denver actual property. What a delisting exhibits is that the vendor nonetheless has energy on this market and in the event that they don’t get the value they need then so be it they simply take the home off the market. This exhibits that sellers in Denver aren’t in a misery state of affairs the place they must promote. If this have been the case, then Denver actual property would proceed growing whereas costs fell, however the reverse is going on.

Due to the robust place sellers are in they’re maintaining the Denver market mainly flat which is probably going one of the best situation for costs.

Will this delisting pattern in Denver final

My intestine says that many householders in Denver are sitting with low charges and good fairness and aren’t in a pressured state of affairs to do something. As a substitute of promoting possibly they are going to rework the home or do an enlargement to fulfill their wants. This might result in costs mainly caught the place they’re with attainable small declines downward, however no large correction out there.

The flip aspect of the delisting debate is that macro elements may finally power gross sales. For instance a powerful financial downturn that results in job losses. This might result in extra pressured gross sales albeit not an 08 massacre in Denver.

Delisting is sweet for the Denver market

Though the delisting pattern in Denver isn’t good for consumers attempting to find decrease costs, delisting is an effective signal for Denver actual property. The Delisting pattern in Denver exhibits that sellers aren’t in a pressured place to do something which means that sellers are nonetheless sitting on good fairness and low charges till they get their desired quantity that makes it value it to maneuver.

A surge in Delistings exhibits the energy of the Denver market and in addition limits the draw back threat to costs within the quick time period. The million greenback query is will Denver sellers sooner or later enter right into a pressured place the place they should promote attributable to financial or different elements. Sadly I don’t have a magic 8 ball to foretell if/when this example will happen, however everybody must be conscious that the delisting pattern may reverse shortly main to cost declines, however as of now it doesn’t appear to be this example is immenent.

Within the interim, take pleasure in the excellent news about delistings in Denver which is maintaining stock in examine and costs larger than anticipated. The million greenback query is will this pattern proceed by way of 2026?

Extra Studying/Sources?

https://coloradohardmoney.com/are-politics-leading-to-lower-denver-house-prices/

We’re a Colorado Non-public/ Onerous Cash Lender funding in money!

I would like your assist as my purpose in writing these articles is to supply one of the best data/perception on Colorado Actual Property that you simply can not get anyplace else! Please like and share my articles on linked in, twitter, fb, and different social media and ahead to your pals/associates 😊 I’d vastly admire it.

Glen Weinberg personally writes these weekly actual property blogs based mostly on his actual property expertise as a lender and property proprietor. He’s the proprietor of Fairview Business Lending. Glen has been revealed as an skilled in exhausting cash lending, actual property valuation, financing, and varied different actual property subjects in Bloomberg, Businessweek ,the Colorado Actual Property Journal, Nationwide Affiliation of Realtors Journal, The Actual Deal actual property information, the CO Biz Journal, The Denver Submit, The Scotsman mortgage dealer information, Mortgage Skilled America and varied different nationwide publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and companies loans in Colorado which gives a novel actual property potential of what’s really taking place on the bottom each in Denver and all through Colorado. My purpose of this actual property weblog is to supply an sincere evaluation of what I see taking place in Colorado actual property and the way it will impression actual property homeowners, consumers, realtors, mortgage professionals, and so on…

Fairview is the acknowledged chief in Colorado Onerous Cash and Colorado non-public lending specializing in residential funding properties and industrial properties each in Denver and all through the state. We’re the Colorado specialists having closed hundreds of loans all through the Entrance vary, Western slope, resort communities, and all over the place in between. We additionally reside, work, and play within the mountains all through Colorado and perceive the intricacies of every market.

While you name you’ll converse on to the choice makers and get an sincere reply shortly. We’re acknowledged within the business because the chief in Colorado exhausting cash lending with no upfront charges or some other video games. Be taught extra about Onerous Cash Lending by way of our free Onerous Cash Information. To get began on a mortgage all we want is our easy one web page utility (no upfront charges or different video games). Be taught how you can discover a respected exhausting cash lender and why Fairview is the finest exhausting cash lender for buyers.

Tags: Denver exhausting cash, Denver Colorado exhausting cash lender, Colorado exhausting cash, Colorado non-public lender, Denver non-public lender, Colorado ski lender, Colorado actual property traits, Colorado actual property costs, Non-public actual property loans, Onerous cash loans, Non-public actual property mortgage, Onerous cash mortgage lender, Onerous cash mortgage lender, residential exhausting cash loans, industrial exhausting cash loans, non-public mortgage lender, Onerous Cash Lender, Non-public lender, non-public actual property lender, residential exhausting cash lender, industrial exhausting cash lender, No doc actual property lender