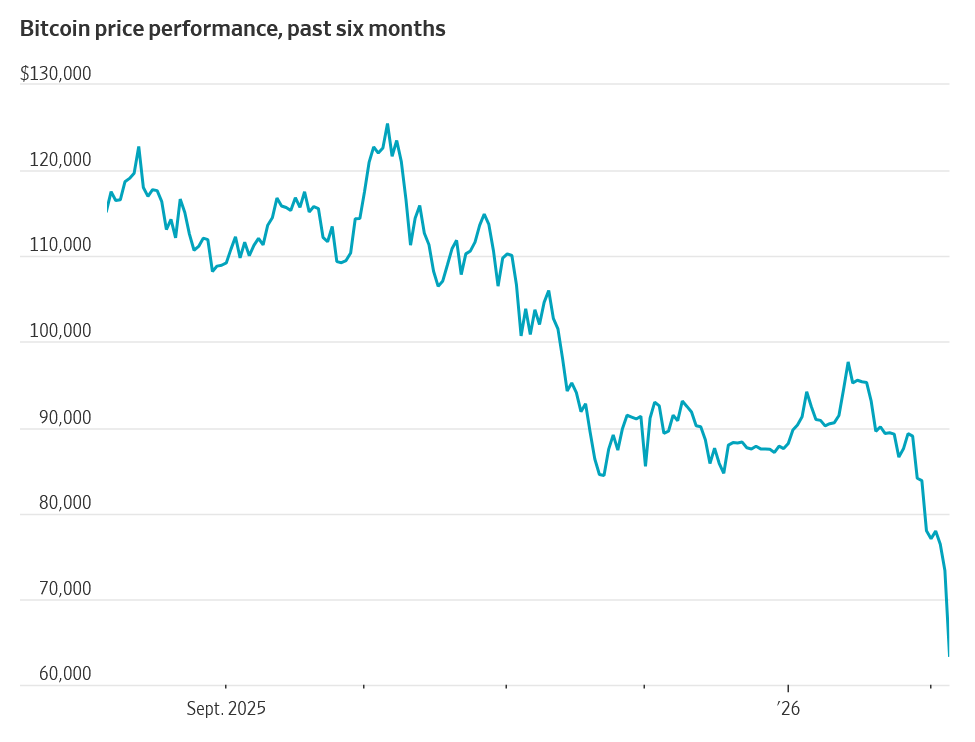

Bitcoin has had a wild experience, declining over 50% in over a month plummeting from a excessive of 120k to 60k. Try the chart above. Why the sudden drop in cryptocurrencies? What does this imply for actual property costs? Trying on the chart under, how will rates of interest be impacted? Can Crypto trigger a contagion impact within the economic system?

Earlier than stepping into the dialogue of Bitcoin and Cryptocurrency it is very important focus on if Cryptocurrency is mostly a foreign money.

What’s foreign money?

First, it is very important outline what a foreign money is. Forex in its most elementary kind is “a system of cash usually use in a specific nation.” Moreover, for a foreign money to be extensively accepted the worth of the foreign money should be comparatively secure. For instance, a greenback immediately is value a greenback tomorrow. Subsequently, many rising economies change for {dollars} to make sure the “shopping for energy” of the foreign money.

What’s cryptocurrency?

“a digital foreign money during which encryption strategies are used to manage the technology of models of foreign money and confirm the switch of funds, working independently of a central financial institution.” Bitcoin is only one sort of cryptocurrency.

Is that this a misnomer to categorise bitcoin and others as foreign money?

Sure, values of bitcoin and different cryptocurrencies have lately had wild swings in worth. One-day bitcoin could be value 30% much less or greater than it was the day earlier than. Conventional secure currencies would not have wild swings in worth. The commodity future buying and selling fee categorised bitcoin as a “commodity”.

Why the massive drops in cryptocurrency now?

The market was caught off guard by the virtually 50% decline in Bitcoin in a really quick time period. This begs the query of why? Listed here are three doable explanations:

- Hedge for shares like gold: Initially many patrons of crypto thought that crypto can be a hedge for shares and gold. The idea goes if there was a inventory market correction, then crypto would react much like gold with a flight to high quality. We’re seeing immediately that this correlation just isn’t holding true as bitcoin has enormously diverged from gold.

- Danger off sentiment: Crypto has at all times been a “dangerous” asset in a portfolio, as volatility elevated available in the market there was a run to the exits and crypto offered off huge time.

- No intrinsic worth to forestall wild swings: When you consider most shares, there’s an intrinsic worth of their property that principally units a value ground. Sadly the identical just isn’t true for crypto as there is no such thing as a intrinsic worth for a ground as we have now seen with a 50% drop in a single month despite the fact that nothing essentially modified with crypto.

Is the drop in cryptocurrency foreshadowing a broader market correction?

That is the million greenback query, does the “threat off” sentiment we’re seeing in crypto foreshadow a bigger market change. We’re already seeing a selloff in lots of tech shares whether or not that is attributable to crypto or the inverse is certainly debatable.

My intestine says that we are going to see a market correction with a heavy focus in tech shares that have been buying and selling at lofty valuations. There might be some firms that get destroyed on account of the bitcoin plunge that have been extremely leveraged and all in on the cryptocurrency bandwagon.

How will actual property be impacted by the drop in cryptocurrency values?

The 2 huge impacts I might watch are inventory market costs and the way the bond market reacts to the drop in crypto:

- Inventory Market: if there’s a bigger inventory market correction then actual property costs may alter downward because the “wealth impact” retains potential patrons on the sidelines. Moreover, if property house owners are closely invested in crypto there could possibly be some pressured promoting for liquidity.

- Rates of interest: check out the chart under, we have now seen yields fall a little bit primarily based available on the market volatility. If there’s a broader correction rates of interest may fall a bit additional which might assist the true property market.

Sadly we have now two opposing forces which might be pulling the true property in numerous instructions. Decrease yields would equate to decrease rates of interest which is a large bonus, however on the flip facet a market correction goes to maintain many patrons on the sidelines and will push extra stock available on the market as sellers want liquidity. At this juncture we have no idea which of those opposing impacts will win out and due to this fact the impression on actual property continues to be a query mark in my thoughts.

Will cryptocurrency reset trigger a recession?

Michael Burry, who rose to prominence for his wager in opposition to the US housing market forward of the 2008 monetary disaster, warned that Bitcoin’s plunge may deepen right into a self-reinforcing “demise spiral,” inflicting lasting injury on firms which have spent the previous yr stockpiling the token.

I’m not sure Bitcoin unto itself would trigger a recession, however that doesn’t imply a recession is not going to occur. On the identical time Crypto is plunging there are different occasions taking place available in the market: a softening labor market, a reset in AI valuations, a threat off sentiment, and so on…. all of this stuff are interplayed and will simply trigger a recession or they trigger a market reset however a recession is prevented, or this complete bitcoin crash turns into a non occasion and the market continues alongside.

What occurs now with the crypto meltdown and what do you have to do

No matter whether or not there’s a recession within the fast future, there’s appreciable threat within the economic system with lofty valuations, enormous leverage in firms, enormous debt a great deal of customers, and plenty of buyers shifting from investing to playing in extremely dangerous property. All these components are usually not good for the economic system however they will work themselves out with out a main recession. Lengthy and quick no one is aware of, however the dangers to the economic system are positively pointed in direction of the draw back.

Actual property can be tilted in direction of the draw back in most markets attributable to larger financial developments and uncertainty however that doesn’t imply there’s a enormous reset in costs coming for actual property though you possibly can see declines within the 5-10% vary which is my base case for the approaching yr.

A very powerful query we’ll get to see answered sooner or later is how does the massive leverage within the economic system unwind. Each firms and customers are carrying enormous debt masses that in the end will have to be paid, with a small financial hiccup extremely levered individuals and corporations are at a lot larger threat of the contagion impression. Though, at present it doesn’t appear like Crypto is the set off for a larger market correction, it’s a warning that the experience forward goes to get extraordinarily bumpy so now can be a great time to exit when you don’t have the abdomen or buckle up for the experience.

Extra studying/assets

- https://finance.yahoo.com/information/michael-burry-warns-cascading-effects-001910407.html

- https://www.cnbc.com/2026/02/06/bitcoin-price-today-60000-in-focus.html

- https://coloradohardmoney.com/what-does-colorados-debt-mean-for-real-estate-prices/

- https://www.fairviewlending.com/what-will-be-the-average-30-year-rate-in-2026/

We’re a Non-public/ Laborious Cash Lender funding in money!

Glen Weinberg personally writes these weekly actual property blogs primarily based on his actual property expertise as a lender and property proprietor. I’m not an armchair reporter/author. We’re an precise personal lender, lending our personal cash. We service our personal loans and personal industrial and residential actual property all through the nation.

My day job is and continues to be personal actual property lending/ exhausting cash lending which permits me to have a novel perspective available on the market. I don’t settle for any paid sponsorships or adverts on my weblog to make sure correct info. I’ve been penning this for nearly 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, fb, and different social media and ahead to your folks 😊. I might enormously respect it.

Fairview is a exhausting cash lender specializing in personal cash loans / non-bank actual property loans in Georgia, Colorado, and Florida. We’re acknowledged within the trade because the chief in exhausting cash lending/ Non-public Lending with no upfront charges or every other video games. We fund our personal loans and supply trustworthy solutions rapidly. Be taught extra about Laborious Cash Lending by our free Laborious Cash Information. To get began on a mortgage all we want is our easy one web page utility (no upfront charges or different video games). Be taught methods to discover a respected exhausting cash lender and why Fairview is the greatest exhausting cash lender for buyers.

Written by Glen Weinberg, COO/ VP Fairview Industrial Lending. Glen has been printed as an skilled in exhausting cash lending, actual property valuation, financing, and numerous different actual property subjects in Bloomberg, Businessweek ,the Colorado Actual Property Journal, Nationwide Affiliation of Realtors Journal, The Actual Deal actual property information, the CO Biz Journal, The Denver Publish, The Scotsman mortgage dealer information, Mortgage Skilled America and numerous different nationwide publications.

Tags: Laborious Cash Lender, Non-public lender, Denver exhausting cash, Georgia exhausting cash, Colorado exhausting cash, Atlanta exhausting cash, Florida exhausting cash, Colorado personal lender, Georgia personal lender, Non-public actual property loans, Laborious cash loans, Non-public actual property mortgage, Laborious cash mortgage lender, residential exhausting cash loans, industrial exhausting cash loans, personal mortgage lender, personal actual property lender, residential exhausting cash lender, industrial exhausting cash lender, No doc actual property lender