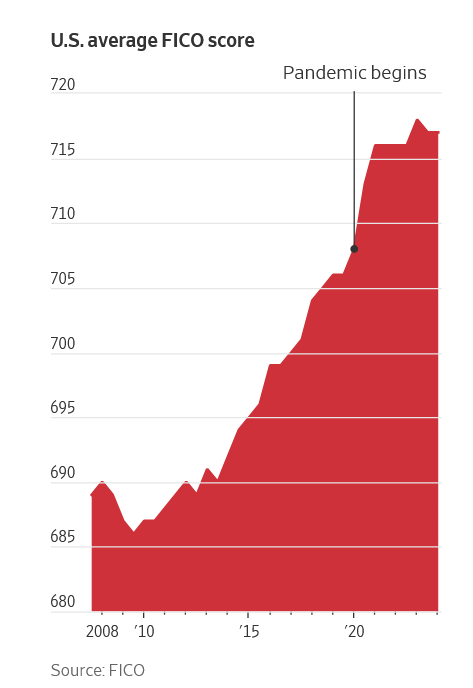

Wow, have a look at the large will increase in credit score scores over the past 15 years. This has occurred whilst scholar debt, auto debt, and bank card debt have all surged. Has the US all of the sudden turn out to be rather more credit score worthy or has one thing else modified? What does this imply for actual property?

Why did credit score scores enhance a lot?

Sorry to burst the bubble, credit score scores haven’t elevated because of any basic modifications by People. Listed here are the three drivers:

- Pandemic stimulus: The federal government printed cash and handed it out like sweet to American’s that might use these funds to pay down bank card debt, automobile debt, and so forth…

- Much less gadgets on credit score report: listed here are only a few gadgets that now not present in your credit score stories:

- Judgements: for instance somebody didn’t pay their lease and the property proprietor go ta judgement, this doesn’t present on the credit score report

- Tax Liens

- Medical Debt

- Pupil Debt for the final 5 years

- Pupil mortgage funds: only a few have paid scholar loans over the past 5 years, this has given an enormous increase in money movement to hundreds of thousands of debtors.

Is a credit score rating like premiere standing on airways?

After I noticed the chart above, the very first thing that got here to thoughts is premiere standing on airways. Traditionally only a few had the highest credit score scores identical to only a few had high tier premier standing on airways, quick ahead and go to the airport and now everybody has premier standing on an airline identical to as we are able to see from the chart, everybody now has an incredible credit score rating.

Scores are now not indicative of precise threat

Sadly with the modifications above to credit score scores, they’re now not indicative of precise threat. Fannie/Freddi haven’t elevated their minimal credit score rating requirements to compensate for the “grade inflation” which implies that riskier debtors certified for riskier merchandise with decrease down funds. Primarily the federal government by not rising credit score rating necessities because of the inflation of credit score scores has led to very large will increase in threat.

Change the requirements to extend homeownership

Simply as within the final disaster, free underwriting requirements took down many banks, brokerages, householders, and traders. Are we going to make the identical mistake once more? Completely! To extend the homeownership fee, Fannie/Freddie (now successfully owned by the US authorities) have successfully been loosening requirements because of “grade inflation” of credit score scores. This has enabled extra debtors to make decrease down funds because of a better credit score rating.

How do we all know requirements are loosening?

70% of all purchases over the past 12 months had been low down cost loans. Debtors placing between 5 to 9 p.c down grew at double the market common (supply: Black Knight Analytics). Moreover, over 35% of all lending by the federal government sponsored entities, Fannie/Freddie that are backed up by US taxpayers, was subprime (lower than 10% down); that is up from 5% in 2010 (Bloomberg)

What’s Subprime lending and why is that this necessary?

Subprime lending (or non-prime) is mainly any mortgage the place the borrower places lower than 20% down and/or don’t meet conventional credit score/revenue tips. No matter credit score or different rations, within the final disaster, we noticed that Mortgage to worth was the primary indicator of a loss which shouldn’t be shocking to anybody.

Why is 20% the magic quantity?

Let’s have a look at what occurred over the past recession. Keep in mind costs can go lower and reduce considerably. The final recession confirmed that debtors with lower than 20% down had been considerably extra prone to default on their loans. Why? In a recession with values dropping when you put solely 5% down, the borrower is underwater virtually instantly. In different phrases, the home is value lower than it’s owed. It doesn’t take a deep recession to see a 5-10% drop in values. A bit of hiccup within the economic system may knock costs down 5-10% particularly in larger value areas just like the Colorado entrance vary the place debtors are spending bigger parts of their revenue on housing.

Wait, all the things is totally different now within the mortgage market! We can’t have the identical points once more with Dodd Frank, and so forth…!

I hear the arguments now, default charges are on the lowest because the recession, underwriting is more durable, credit score scores are larger and the listing goes on. Sadly, none of those arguments maintain water, subprime is again and the brand new lender on the town is you and I the taxpayer via our possession in Fannie/Fredie.

LTV primary indicator of loss

Being a personal lender and driving via the final mortgage disaster with no bailout from the federal government, we realized actual fast what occurs in a market downturn. The primary issue on whether or not a lender will take a loss is Mortgage to Worth. As a personal lender within the final disaster we had a singular perspective to see how our lending practices carried out beneath stress. We lend our personal funds, have a look at each property, and repair our loans. We get to see the entire mortgage cycle versus many banks that pool their loans and securitize them offloading the danger to different events. Because the disaster unfolded we unfold out the portfolio primarily based on credit score, revenue, mortgage to worth, and so forth… the first indicator of whether or not we’d take a loss or not was the quantity of leverage the borrower utilized. The decrease the mortgage to worth, the upper chance of a constructive decision.

What occurs in a downturn?

A cascading impact happens; the market falls, dampens client confidence, decreases client spending and companies in flip in the reduction of to accommodate the decrease spending stage (layoffs, fewer purchases, and so forth…). Debtors which have fairness of their industrial or residential property are significantly extra prone to make a cost. Within the final disaster, there have been a substantial variety of “strategic defaults” the place the borrower may make a cost however selected to not because the home was underwater. The speculation goes “why throw good cash away once I can go lease or purchase one other home for lower than what I at present owe?”. It is a simplistic rationalization of what occurred within the final disaster and what’s going to occur once more. The depth of how this performs out within the subsequent disaster is the query.

What does this need to do with Fannie/Freddie the biggest purchasers of residential mortgages? With 35% of mortgages originated having lower than 10% down, the chance of main defaults has been amplified. It’s extremely possible that there’ll have to be an enormous bailout by U.S. taxpayers to the tune of 100 billion {dollars} (Bloomberg) or extra (this doesn’t embrace bailouts of FHA or VA which additionally makes subprime loans with down funds lower than 5%!).

We haven’t realized our lesson!

We’re already beginning to see the start impacts of inflated credit score scores. Debt counselors throughout the nation say their consumer bookings are equal to or exceed the quantity in 2019. Lenders catering to low- or middle-income individuals have taken a success. Moreover, nonprime debtors monitored by FICO in April spent 13% extra of their credit score traces on common than when Covid-19 landed, whereas falling behind on financial institution card funds previously 12 months 28% extra usually.

By the federal government artificially rising credit score scores, we now have created an enormous threat to the economic system that’s hiding in plain sight! Moreover, it is perplexing that we’re repeating related errors that led to the collapse of varied banks a decade in the past. GSEs (Fannie and Freddie), which we because the taxpayer are funding/guaranteeing, are the brand new threat on the town. They’ve elevated their subprime lending from 5% in 2010 to 35% in 2018. Moreover, the grade inflation of credit score scores has compounded the danger to the complete mortgage market and different debt markets that finally will probably be paid as we’re simply starting to see. The scary half is that there isn’t any technique to totally quantify the danger to credit score high quality because of grade inflation aside from I do know it’s a large quantity. We should wait and see the precise figures when the economic system resets.

Extra Studying/Sources

- https://www.lendingtree.com/dwelling/mortgage/down-payment-help-survey/

- https://www.wsj.com/personal-finance/a-credit-score-hangover-is-hitting-americas-riskiest-borrowers-b292d08b

- https://www.experian.com/blogs/ask-experian/judgments-no-longer-included-on-credit-report/

- https://www.marketwatch.com/story/credit-scores-got-artificially-higher-during-covid-now-many-borrowers-cant-pay-their-debts-4e44136a

- https://www.fairviewlending.com/higher-credit-score-borrowers-pay-more-under-new-government-rule/

- https://www.fairviewlending.com/top-hard-money-questions-and-answers/

We’re a Personal/ Arduous Cash Lender funding in money!

Glen Weinberg personally writes these weekly actual property blogs primarily based on his actual property expertise as a lender and property proprietor. I’m not an armchair reporter/author. We’re an precise personal lender, lending our personal cash. We service our personal loans and personal industrial and residential actual property all through the nation.

My day job is and continues to be personal actual property lending/ exhausting cash lending which allows me to have a singular perspective available on the market. I don’t settle for any paid sponsorships or advertisements on my weblog to make sure correct info. I’ve been scripting this for nearly 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, fb, and different social media and ahead to your mates . I’d drastically respect it.

Fairview is a exhausting cash lender specializing in personal cash loans / non-bank actual property loans in Georgia, Colorado, and Florida. We’re acknowledged within the trade because the chief in exhausting cash lending/ Personal Lending with no upfront charges or another video games. We fund our personal loans and supply trustworthy solutions rapidly. Study extra about Arduous Cash Lending via our free Arduous Cash Information. To get began on a mortgage all we want is our easy one web page software (no upfront charges or different video games).

Written by Glen Weinberg, COO/ VP Fairview Business Lending. Glen has been revealed as an knowledgeable in exhausting cash lending, actual property valuation, financing, and varied different actual property matters in Bloomberg, Businessweek ,the Colorado Actual Property Journal, Nationwide Affiliation of Realtors Journal, The Actual Deal actual property information, the CO Biz Journal, The Denver Publish, The Scotsman mortgage dealer information, Mortgage Skilled America and varied different nationwide publications.

Tags: Arduous Cash Lender, Personal lender, Denver exhausting cash, Georgia exhausting cash, Colorado exhausting cash, Atlanta exhausting cash, Florida exhausting cash, Colorado personal lender, Georgia personal lender, Personal actual property loans, Arduous cash loans, Personal actual property mortgage, Arduous cash mortgage lender, residential exhausting cash loans, industrial exhausting cash loans, personal mortgage lender, personal actual property lender, residential exhausting cash lender, industrial exhausting cash lender, No doc actual property lender