In Colorado you can be receiving your new tax evaluation within the subsequent few weeks (sometimes the start of Could) and time is of the essence as you’ve gotten a restricted window if you wish to combat your tax worth. Your taxes are possible going up though the market has softened/declined. Why? Taking a look at properties over the past a number of years, I’ve seen big disparities in market worth vs the assessed worth with some assessments 30%+ overvalued. That is the 12 months to attraction your property taxes (see beneath for particulars as to why and easy methods to attraction your taxes).

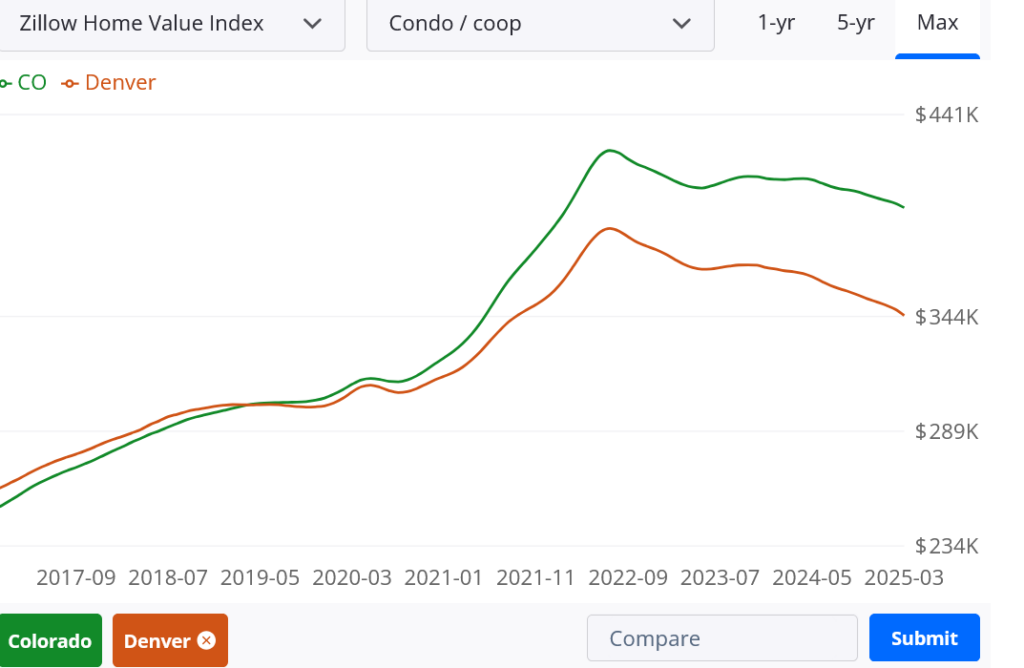

Take a look at the chart beneath on condos, there’s a clear inflection level late 22 that was not captured within the final evaluation which creates an enormous alternative to attraction your property taxes. Under is a free information to attraction your Colorado property taxes and win. I’ve adopted the identical course of and received each attraction!

Moreover there may be one elementary flaw in how assessed values had been calculated through the prior assessments that’s main to large overvaluations on many properties that I’ve seen all through the state which is able to present one other opening for an attraction. Why the large disparity in assessed vs market worth? How are property tax values decided in Colorado? What steps should you’re taking to attraction your Colorado property taxes? Word, don’t depend on the legislature to bail you out of the large tax will increase we now have seen over the past 15 years!

I’ve appealed my property taxes in varied counties all through Colorado and the method is similar in every county. I’ve received each single attraction and even received in 23 a 20% discount on one in all my properties assessed values. Are you able to attraction and win? Completely, however you will need to comply with the principles to a T.

Why is that this 12 months distinctive for property taxes in Colorado?

During the last a number of years; costs have been on a breakneck tempo resulting in hovering property taxes. We have now had basically no breaks within the appreciation of residential and business properties till now. Moreover there was a elementary flaw in how assessed values had been estimated. Lengthy and brief, it’s best to look into interesting your property taxes particularly on the business aspect.

Large elementary flaw in how properties have been assessed?

With the market transferring so shortly the final a number of years, within the final evaluation assessors needed to “carry ahead” gross sales. For instance if a home bought in December of the prior evaluation 12 months, they might add 6 months of “appreciation” to carry that sale to the market worth. Mathematically this is smart on the entire however for particular person properties it could actually result in big disparities. I discovered this out my attraction in 2023.

Listed here are extra particulars:

Sadly, there’s a elementary flaw within the assessor’s reasoning that can assist in the subsequent step of the attraction. The final a number of evaluation years had been distinctive. With such a fast paced market, appreciation was off the charts. Any property that was bought through the evaluation interval needed to be introduced to six/30/22. For instance, if a home bought on 1/1/22 the assessor must modify the gross sales value primarily based on annual appreciation. Within the case of my property, the assessor calculated that homes had been appreciated at 3.2%/ month, so within the instance above if a home bought for 1 million on 1/1/22, the adjusted gross sales value can be (19.2% larger 6 instances 3.2%) resulting in an adjusted worth of 1, 192,000 to make use of as a comparable.

On the floor this appears logical, however as I dug into the info there was a elementary flaw. The assessor was not utilizing “value bands” to precisely calculate the appreciation charge. Sadly, the market proves that this assumption shouldn’t be legitimate. As we see within the knowledge within the mountains a one-million-dollar home appreciates considerably sooner than a 3 million greenback home on a statistical stage. We have now seen this all through the market as decrease priced homes are appreciating sooner than the higher finish of the market.

It’s no shock {that a} 2 million greenback home appreciates considerably slower than an 800 thousand greenback home in a ski city, but the assessor was averaging all of them collectively to find out an appreciation charge. The quantity was considerably totally different, in my case the appreciation charge per 30 days was 50% decrease than the assessor’s. I discovered one other home 4 doorways down that “double bought” through the time interval. Primarily it bought mid 2021 after which once more early 2022. There was 8 months distinction between the gross sales so I may take the appreciation and common it over the 8 month interval. The quantity was considerably decrease than the one utilized by the assessor.

If I exploit the identical instance above with a 2% appreciation charge the distinction is 70k decrease, if I took that over an extended interval relying when the home bought the quantity will likely be even bigger. I’ve seen this happen in any respect value factors all through the state. For instance, I checked out a mortgage on a property in CO springs that was assessed at 450k, the true quantity needs to be nearer to 350k; this can be a big change in taxes for the proprietor of the property. The purpose of the instance above is to indicate that many homes are ripe for attraction as we will now see in precise closed gross sales that the appreciation charge that was utilized was too aggressive and because of this there are tons of properties overvalued that needs to be appealed

How a lot are your Colorado Property taxes going up?

Many markets will nonetheless see will increase because the market actually didn’t begin cooling till concerning the final six months or so. Bear in mind, the assessor makes use of knowledge for this evaluation as much as 6/30/24. Any gross sales after that interval aren’t legitimate. However, as talked about above there are nonetheless a ton of properties which might be overvalued and the market has undoubtedly cooled for the reason that peak

I’ve assembled a free information on Colorado property taxes and the attraction course of

- When are the values decided?

- Why is that this 12 months such a giant leap?

- What are you able to do about it?

- Are additional will increase on the best way?

- 5 tricks to attraction and win

How are property tax values decided and when are they decided?

In Colorado each county is similar, every odd numbered 12 months is a revaluation 12 months ( 2025 is a revaluation 12 months). Through the revaluation interval the tax assessor appears to be like at comparables 18 months prior, so for 2025 they might be utilizing 23 and 24 comparables (to be actual you should utilize a comparable as much as 6/24)

Why are property assessments in Colorado nonetheless rising?

Most areas in Colorado continued to extend in worth in 23 till the summer season of 24. This may result in elevated values relying in your location, property sort, and many others… I doubt the assessor will likely be decreasing many values with out an attraction.

Is assessed worth market worth?

Bear in mind, property tax worth shouldn’t be market worth. Property tax worth is derived from prior gross sales (final summer season and earlier). The market was in a a lot totally different place then than it’s now. The statute in Colorado doesn’t care about present market worth. The rise you might be seeing this 12 months was for “prior” actual property appreciation that’s now simply flowing by to your property worth which in the end determines your property taxes

Are additional will increase on the best way?

I believe the market will likely be flat to declining in most areas for the subsequent a number of years on account of excessive rates of interest together with rising stock.

Must you protest your Colorado Property taxes

Sure, now could be the most effective time within the final 15 years, many properties are considerably overvalued and an attraction may result in substantial property tax financial savings.. There’s little or no draw back danger on an attraction aside from just a few hours of time. The worst I’ve seen assessors say isn’t any and the worth stays the identical. The method is comparatively straightforward. Under is a 5 step information for interesting. Make sure you comply with this to a T to be able to have your attraction thought of and improve your chance of successful.

6 tricks to attraction your Colorado Property taxes and win

I’ve appealed my property taxes in 3 counties all through Colorado and received on each. Under are 6 suggestions that can assist you navigate the attraction and improve your odds of successful.

Earlier than beginning, it is very important notice that the assessor doesn’t care what you “really feel” your property tax worth needs to be, what your zestimate says, or what your latest appraisal was for. The property tax worth is predicated on information throughout a acknowledged time interval. The one technique to have an opportunity at successful an attraction is to comply with the instructions to a T and depart your emotions behind.

- Dates are vital, you’ve gotten till 6/8/25 to attraction. Should you miss these dates you might be out of luck. Most counties assist you to attraction on-line and the method is straightforward (simply google your county + assessor). They sometimes have a easy on-line kind the place you’ll be able to put in your info and the attraction info.

- Observe the principles: keep in mind for this 12 months the one comparables that can be utilized are prior to six/30/24 (sometimes a two 12 months interval), statute says that you just can not return greater than 5 years until there are extenuating circumstances

- Test your information: That is low hanging fruit. Make sure the assessor has your data right, is the property and workplace constructing but categorised as blended use? Is the sq. footage right? Is different info correct. Correcting this data may considerably cut back your tax burden

- On residential, it’s a numbers recreation: How residential value determinations work is the county calculates a neighborhood common and finds gross sales in shut proximity to your own home with comparable traits. The averages can lie. For instance in my neighborhood once I appealed in 17, there have been quite a few decrease gross sales (additionally some larger one), I used to be in a position to make the case that I felt my home was nearer to the decrease gross sales (keep in mind you aren’t speaking about market worth, nor does this affect the sale value of your property, and many others…). I used to be profitable in my attraction and acquired my property worth decreased over 30%

- On Industrial, use each strategies: On a business property each the gross sales and earnings method are used. Should you had a tenant throughout this time interval, the earnings method (take web working earnings divided by the relevant capitalization charge—the earnings method on a business property is a separate article I’ll put up at a later date) is an excellent technique to begin with. The gross sales method is the second technique that may be utilized. Industrial is a little more in depth than the residential attraction since business properties are significantly much less uniform than residential properties. I’d 100% disagree that in Denver county business values both stayed flat or elevated, this isn’t potential with rising cap charges! I’ve seen manner too many buildings considerably overvalued. There are huge alternatives for business property appeals as cap charges have gone up, lease charges have gone down, and emptiness has elevated. Now’s undoubtedly time to attraction in your business property.

- Use varied instruments to get your information straight: To win an attraction, the attraction should be reality primarily based. Saying you “really feel your property is overvalued” is a waste of time. Ensure you have your information straight (at a minimal 3 relevant gross sales for residential; for business tackle each the earnings and gross sales method). You may get each gross sales comparables from the county web sites for a particular neighborhood (don’t use Zillow or Trulia, the sq. footages might be inaccurate, be sure to use the county knowledge to make sure you evaluate above grade sq. footage and additionally, you will need to enter the parcel id numbers for every of your comparables). For a business property use a instrument like loopnet.com or Costar to see what asking rents are , get gross sales comps, and many others… loopnet has many footage and particulars on varied business properties.

- You possibly can attraction your self on residential. On business you’ll be able to attraction your self when you’ve got the instruments/data of earnings method, and many others…. however you can too rent any person to assist.

Abstract

Lengthy and brief, Colorado is a bit distinctive in that though actual property costs are falling/softening there’ll nonetheless be some jumps in taxes because the prior will increase haven’t absolutely factored in. Happily, you do have the power to protest and now could be the best possible time in years to attraction and win particularly on the business aspect or in case you personal a residential rental. Should you do attraction, be sure to comply with the steps above to the T to extend your odds of successful.

Additionally notice, don’t take your frustration of upper taxes out on the assessor as they’re simply following the legislation, in case you don’t like the upper taxes, the legislature, governor, and poll field is the place it’s best to focus your efforts. Bear in mind one of many key causes for the large leap in taxes is the elimination of the Gallagher modification that balanced business with residential assessments which led to large jumps in residential property taxes.

Moreover many counties like Denver county proceed to vote for larger property taxes for absolutely anything you’ll be able to consider; so even when your worth goes down, your taxes are nonetheless going up in locations like Denver on account of larger mill levies for every little thing underneath the solar.

Extra Studying/Assets:

- https://car-co.stats.showingtime.com/docs/lmu/2020-06/x/DenverCounty?src=web page

- https://www.steamboatpilot.com/information/property-taxes-101-owners-should-prepare-for-big-increases-on-may-notice/

- https://coloradohardmoney.com/class/colorado-property-taxes/

- https://coloradohardmoney.com/another-property-tax-compromise-2-tax-ballot-questions-pulled/

- https://www.9news.com/article/information/native/front-range-property-values-assessors/73-15bdf1f7-c228-4c4f-b9b4-3cd588279ea5

We’re a Colorado Personal/ Exhausting Cash Lender funding in money!

I want your assist! Don’t worry, I’m not asking you to wire cash to your long-lost cousin that’s going to provide you one million {dollars} in case you simply ship them your checking account! I do want your assist although, please like and share our articles on linked in, twitter, fb, and different social media and ahead to your mates/associates I’d drastically recognize it.

Written by Glen Weinberg, Proprietor Fairview Industrial Lending. Glen has been revealed as an professional in laborious cash lending, actual property valuation, financing, and varied different actual property matters in Bloomberg, Businessweek ,the Colorado Actual Property Journal, Nationwide Affiliation of Realtors Journal, The Actual Deal actual property information, the CO Biz Journal, The Denver Submit, The Scotsman mortgage dealer information, Mortgage Skilled America and varied different nationwide publications.

Fairview is the acknowledged chief in Colorado Exhausting Cash and Colorado non-public lending specializing in residential funding properties and business properties each in Denver and all through the state. We’re the Colorado consultants having closed hundreds of loans all through the Entrance vary, Western slope, resort communities, and in all places in between.

Once you name you’ll communicate on to the choice makers and get an sincere reply shortly. They’re acknowledged within the trade because the chief in laborious cash lending with no upfront charges or another video games. Be taught extra about Exhausting Cash Lending by our free Exhausting Cash Information. To get began on a mortgage all we’d like is our easy one web page software (no upfront charges or different video games)

Tags: Exhausting Cash Lender, Personal lender, Denver laborious cash, Denver Colorado laborious cash lender, Colorado laborious cash, Colorado non-public lender, Denver non-public lender, Colorado ski lender, Colorado actual property developments, Colorado actual property costs, Personal actual property loans, Exhausting cash loans, Personal actual property mortgage, Exhausting cash mortgage lender