A deed of belief helps debtors safe loans for actual property transactions. In the identical approach a mortgage is an settlement together with your lender, the deed of belief outlines the phrases and circumstances of the mortgage.

Understanding how a deed of belief works is essential for debtors as a result of it could actually have an effect on the foreclosures course of and all events’ rights.

Preserve studying to study extra concerning the deed of belief definition, the way it works, and why it’s vital.

What’s a Deed of Belief

A belief deed, or deed of belief, is a authorized settlement between the three events concerned in an actual property mortgage: the trustor (borrower), the trustee (impartial third occasion), and the beneficiary (lender).

Whether or not you’re taking out a onerous cash mortgage for rental properties or a second house mortgage, a deed of belief offers the title of a property to the trustee, usually a mortgage title firm or dealer, that holds it “in belief” as collateral for the mortgage offered by the lender.

The deed of belief consists of vital particulars such because the mortgage quantity, the compensation schedule, the rate of interest, and any circumstances or covenants associated to the mortgage. Like a mortgage, a deed of belief serves because the settlement between the borrower and lender and could also be used for any and all forms of mortgage applications. Relying on the place you reside, it’s possible you’ll be required to make use of a deed of belief slightly than a mortgage. If the borrower doesn’t repay the mortgage as agreed (also called defaulting on the mortgage), the trustee can provoke the non-judicial foreclosures course of to promote the property and fulfill the debt.

This authorized doc gives safety for the lender, guaranteeing that the property could be offered to recuperate the remaining mortgage quantity in case of default, whereas the borrower retains equitable title and the proper to make use of the property so long as they proceed to repay their mortgage.

Key Elements of Belief Deeds

A belief deed secures actual property loans and contains a number of key parts that define the settlement and duties of all three events concerned. Key parts embrace:

- Promissory be aware: The promissory be aware outlines the phrases of the mortgage in the identical approach a mortgage settlement would. It consists of the quantity borrowed, rate of interest, compensation schedule, and maturity date.

- Property description: It is a detailed authorized description of the property getting used as collateral.

- Energy of sale clause: This clause is a provision by which the trustee has the authority to promote the property in a non-judicial (no courts) foreclosures if the borrower defaults on the mortgage.

- Default provisions: These are the circumstances below which the borrower is taken into account in default, equivalent to missed funds or breach of circumstances like sustaining the property and paying property taxes.

- Reconveyance clause: This clause obligates the trustee to switch the title again to the borrower as soon as the mortgage is absolutely repaid.

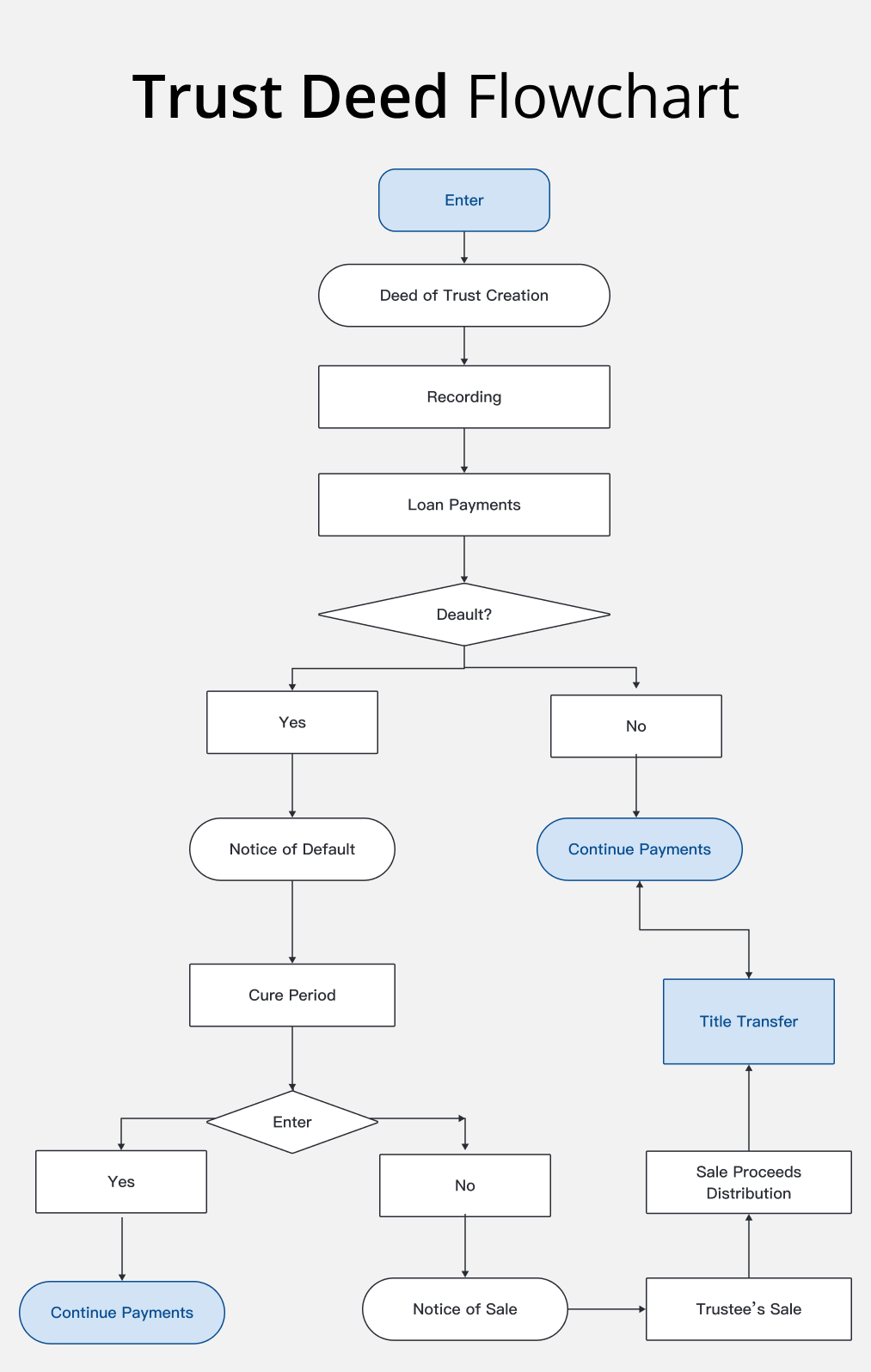

How a Deed of Belief Works

When somebody takes out a mortgage to buy property, the lender requires some strategy to safe their curiosity in case the borrower defaults. As an alternative of a standard mortgage, a deed of belief transfers the title of the property to a impartial third occasion, the trustee, who holds it as collateral for the mortgage. The borrower retains the equitable title and proper to make use of the property so long as they adhere to the phrases of the mortgage.

All through the mortgage time period, the borrower makes common funds to the lender, which incorporates curiosity and principal. If the borrower fails to do that, the deed of belief offers the trustee the authority to start the non-judicial foreclosures course of. This course of includes promoting the property at a public public sale to repay the excellent mortgage quantity.

As soon as the borrower repays the mortgage, the trustee offers them the authorized title again, releasing the lien on the property. This course of protects the lender and gives the borrower with a transparent path to property possession as soon as they meet their monetary obligations.

In lots of states lenders can select between a deed of belief or mortgage, whereas in others solely belief deeds could also be accessible.

Deed of Belief vs. Mortgage Similarities vs. Variations

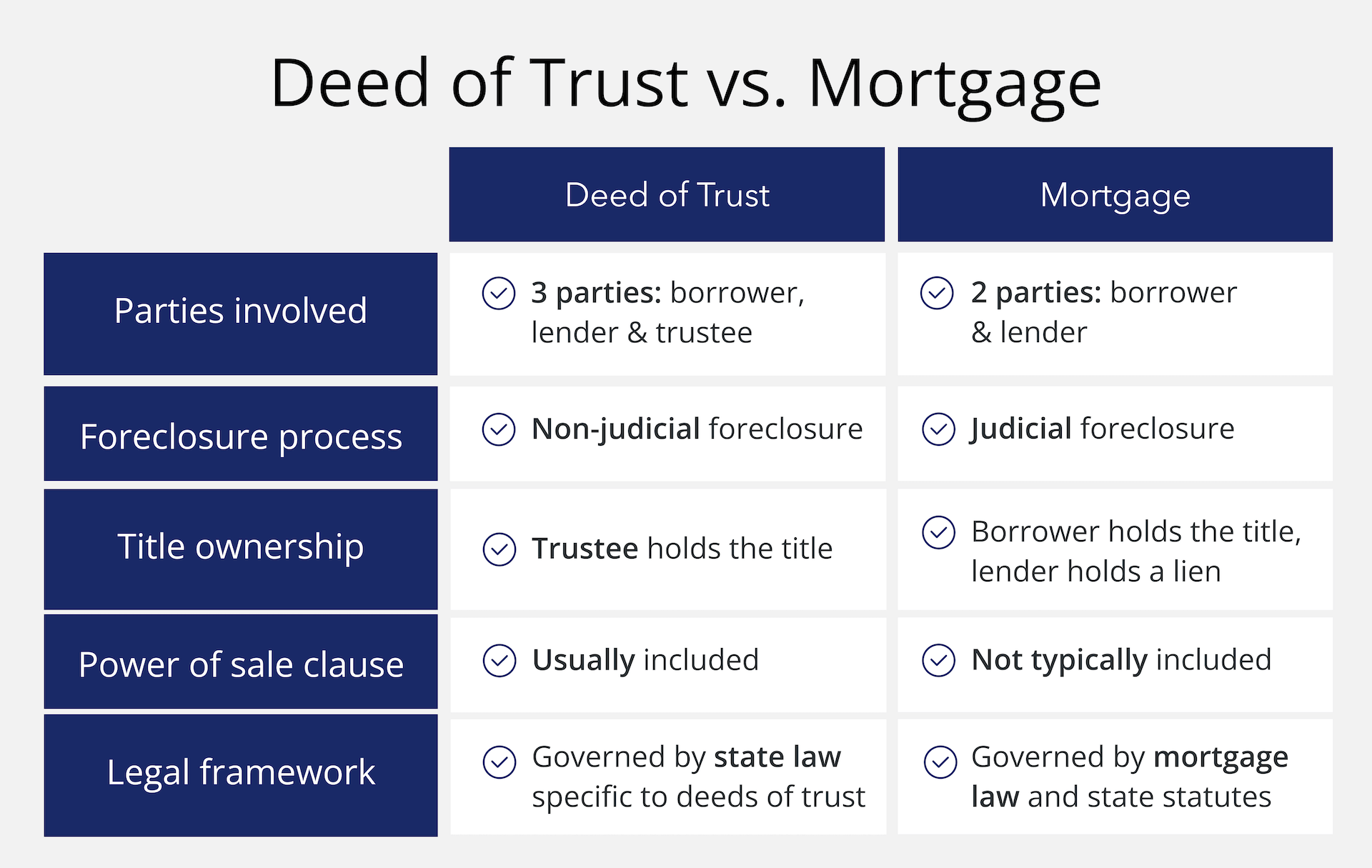

Evaluating a deed of belief vs. mortgage, each are strategies for securing actual property loans, guaranteeing the lender’s declare on the property ought to the borrower default on the mortgage. Each mortgages and deeds of belief are ruled by state legal guidelines and require correct execution and recording to be legitimate and enforceable. Nonetheless, there are key variations between a deed of belief vs. mortgage, together with:

- Events concerned: The deed of belief includes the trustor, trustee, and beneficiary. However, mortgages solely contain two events — the borrower and the lender.

- Foreclosures course of: A deed of belief permits for non-judicial foreclosures, which is quicker and cheaper as a result of it doesn’t require permission from the courts. Nonetheless, a mortgage typically requires judicial foreclosures, which includes courtroom proceedings and could be extra expensive and time-consuming.

- Title holding: With a deed of belief, the third-party trustee holds the property’s title till the mortgage is repaid. Conversely, debtors with a mortgage retain authorized title to the property whereas the lender holds a lien on the property.

Advantages of Belief Deeds

A deed of belief provides a number of benefits over mortgages for debtors and lenders:

Pace & Effectivity

With a deed of belief, the trustee can promote the property with out involving the courts. This streamlined course of reduces the time it takes to resolve a default, permitting for faster decision and fewer stress for the borrower in comparison with the prolonged judicial foreclosures course of related to mortgages.

Lowered Authorized Prices

The non-judicial foreclosures course of additionally ends in decrease authorized charges as a result of it bypasses the courtroom system. Avoiding courtroom charges and prolonged authorized procedures can save debtors cash, decreasing the monetary burden if foreclosures turns into obligatory.

Clear Foreclosures Path

A deed of belief gives a transparent and predefined path for foreclosures, decreasing ambiguity and potential disputes. The trustee manages the foreclosures course of, guaranteeing that the phrases agreed upon within the belief deed are adopted exactly. This readability can stop stage challenges and streamline the decision of defaults to supply debtors with a extra easy and predictable course of.

Belief Deed Concerns

When contemplating a deed of belief, debtors should perceive the important thing clauses — the facility of sale and reconveyance. The facility of sale clause offers the trustee the flexibility to promote the property for those who default in your mortgage. Which means that the property could be offered to fulfill the debt, so it’s vital to make well timed mortgage funds.

Equally vital is the reconveyance clause, which prompts as soon as the mortgage is absolutely repaired. This clause requires the trustee to switch the authorized property title again to you, launch the lien, and ensure that you simply’ve paid off your mortgage. Understanding this clause ensures that your possession of the property is absolutely acknowledged, and the lender can’t make any claims in opposition to it.

Steps to Take if You Have a Deed of Belief

If in case you have a deed of belief securing your actual property mortgage, there are a number of steps it’s best to take to ensure you fulfill your obligations and defend your pursuits:

Guarantee Correct Recording

Confirm that the deed of belief is appropriately recorded with the county recorder’s workplace. Correct recording establishes the validity of the doc and gives discover to the general public of the lender’s lien on the property.

Assessment the recording particulars to substantiate accuracy and completeness, as any errors might have an effect on the enforceability of the deed of belief.

Preserve Communication with Your Lender

Open and ongoing communication together with your lender will help you resolve cost points shortly for those who encounter any monetary challenges or anticipate problem making funds.

Notify your lender as quickly as doable to debate your scenario and discover different preparations or options that may allow you to keep away from default and foreclosures.

Keep Present on Funds

Maintaining together with your mortgage funds ensures you keep away from defaulting, which triggers foreclosures proceedings. Making funds on time in accordance with the phrases outlined within the deed of belief will stop any misunderstandings that may make your lender assume you aren’t paying your mortgage off.

Deed of Belief: FAQs

Can I promote my property if there’s a belief deed on it?

Sure, you’ll be able to promote your property if there’s a deed of belief on it. In these circumstances, you’ll use the sale proceeds to repay the excellent mortgage steadiness, and also you’ll hold something left over.

How do I take away a deed of belief from my property?

The one positive strategy to take away a deed of belief out of your property is thru reconveyance. While you repay the mortgage in full, the lender offers you a doc detailing your satisfaction of the deed of belief. This doc is your proof that the mortgage has been repaid. You or your lender can then request a reconveyance from the trustee named within the deed of belief, and a brand new doc will likely be filed with the county recorder’s workplace eradicating the deed of belief from the property’s title.

What’s a 1st belief deed?

A 1st belief deed is the primary lien or mortgage secured by the property, the place the lender holds the first lien place. Which means that within the occasion of default and foreclosures, the lender with the first belief deed has the primary declare on the property’s proceeds from the sale.

What’s a 2nd belief deed?

A 2nd belief deed is basically a second mortgage utilizing the identical property as collateral. This mortgage is simply repaid after the first belief deed is absolutely happy within the occasion of foreclosures.

Can a deed of belief be refinanced?

A deed of belief could be refinanced, changing the unique mortgage with a brand new one. Many individuals do that to acquire extra favorable phrases like a decrease rate of interest or an extended compensation interval. Refinancing requires you to undergo a brand new mortgage software course of to get approval. Then, as soon as the brand new mortgage is funded, it’s used to repay the unique mortgage and a brand new deed of belief is recorded to safe the refinanced mortgage.

Safe Quick Funding with Onerous Cash Loans

A deed of belief isn’t that a lot completely different from a mortgage mortgage — it simply requires a 3rd occasion that holds the title as collateral till the mortgage is paid off. In lots of states lenders can select between a deed of belief or mortgage, whereas in others solely mortgages could also be accessible.

When conventional financing isn’t an possibility, otherwise you want fast entry to capital, Supply Capital will help with onerous cash loans. We provide each 1st and 2nd belief deeds, permitting you to leverage your property’s fairness. Expertise the comfort of same-day approvals and shutting in simply 7-10 days so that you get the funding you want at once. Apply now to see for those who qualify for a tough cash mortgage.

Try the most recent piece from Card Charges on Supply Capital!