Definition of Onerous Cash

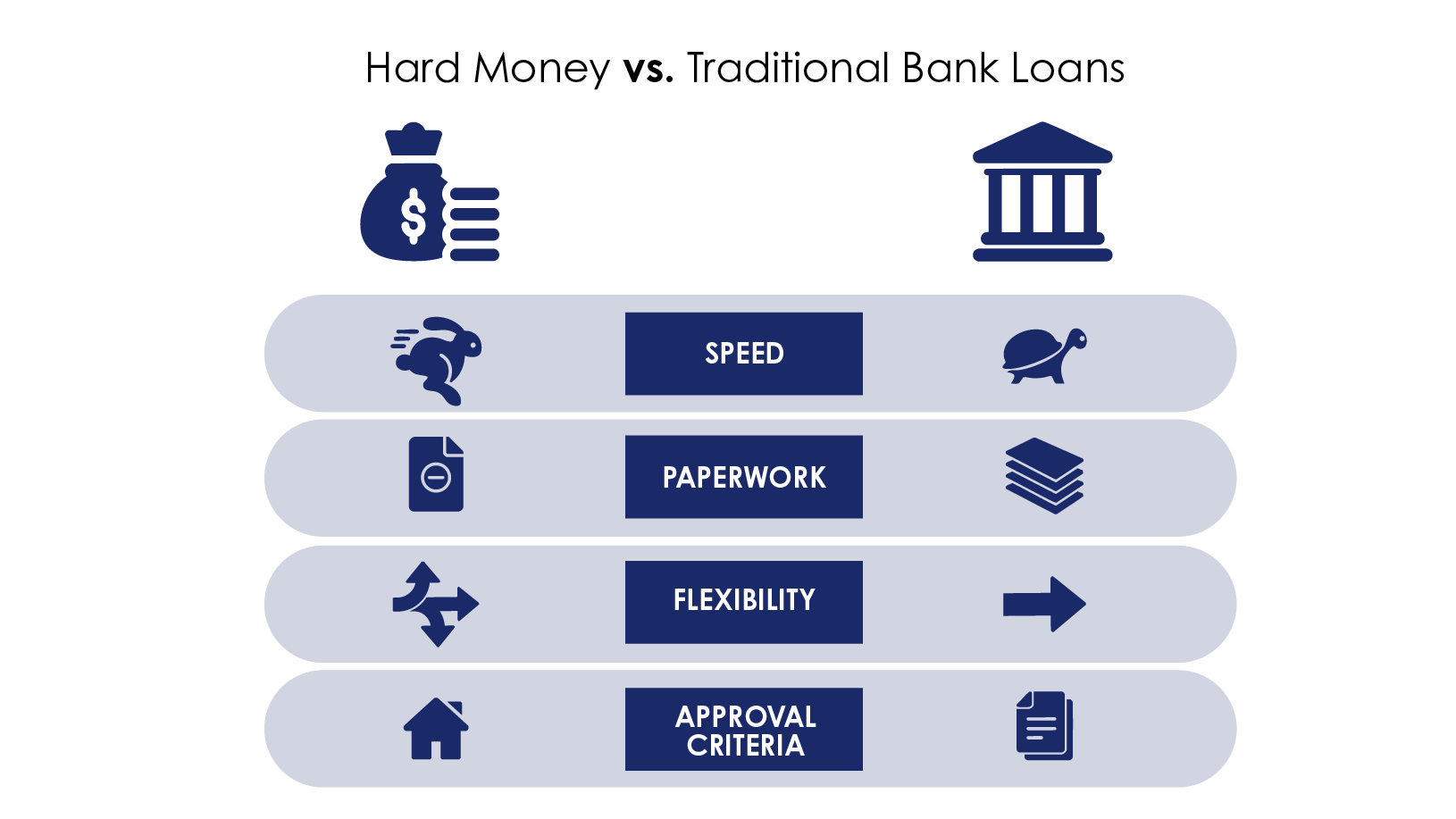

Onerous cash, typically additionally known as “non-public cash”, is the time period used for loans secured by actual property which might be funded by non-public events and are sometimes provided at greater rates of interest than an FDIC insured financial institution. Onerous cash underwriting pointers are virtually at all times much less invasive and time consuming than the rules adopted by a standard financial institution or monetary establishment.

Debtors search arduous cash loans when they’re unable or do not need the luxurious of time to attend for financing from extra typical sources. This may be as a consequence of quite a few causes, that are mentioned within the subsequent part.

Why Debtors Select Onerous Cash Loans

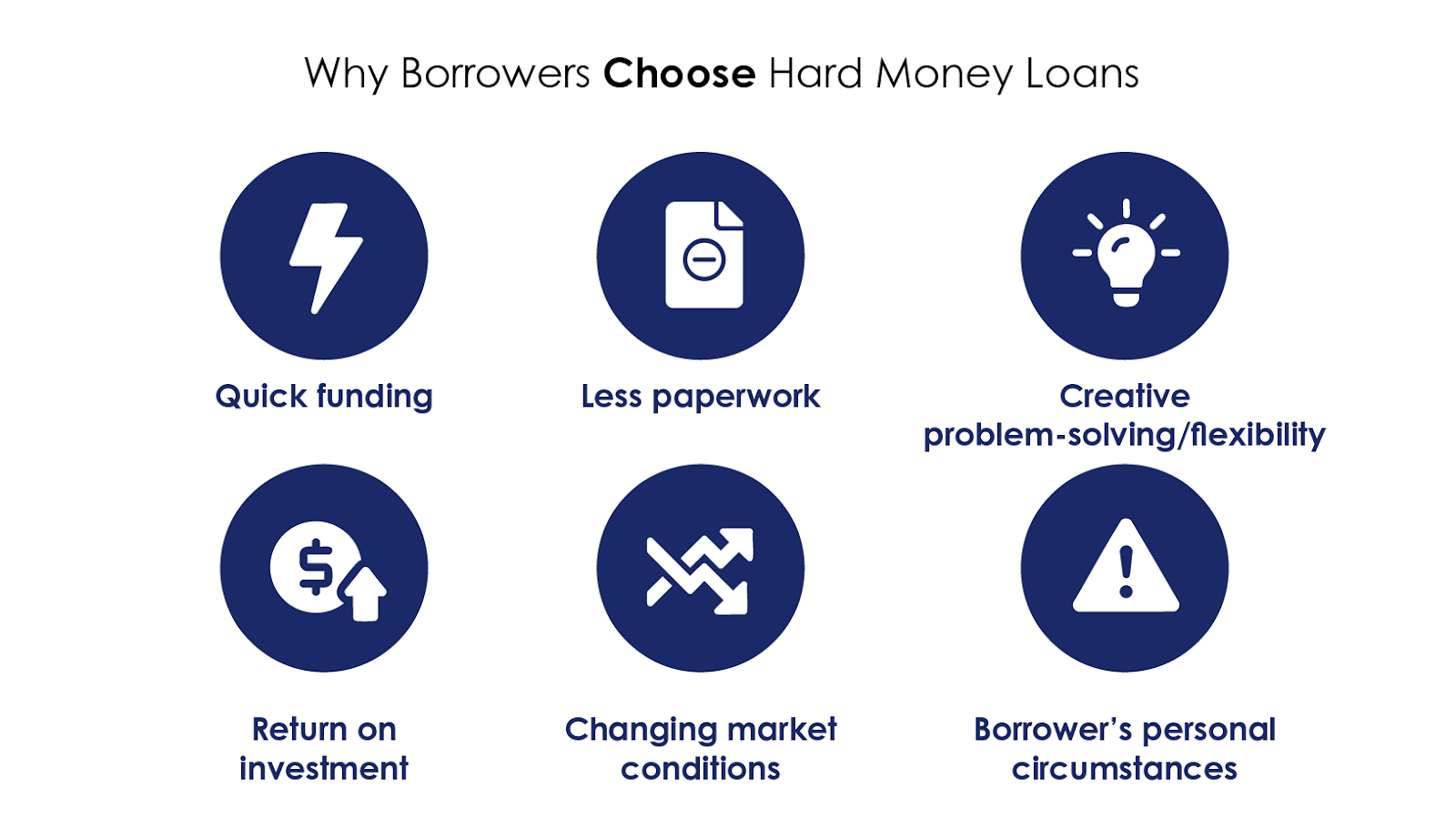

The query usually arises as to why debtors would search a non-public cash mortgage for actual property on the excessive rates of interest that non-public cash calls for. The quick assumption is that these are high-risk ventures and the debtors do not need the credit-worthiness that may permit them to borrow from conventional and traditional sources. There are in actual fact all kinds of things that decide whether or not or not a borrower can be a candidate for a non-public cash mortgage. Let’s have a look at a number of extra frequent causes under:

✓ Fast Funding of a Time Delicate Mortgage

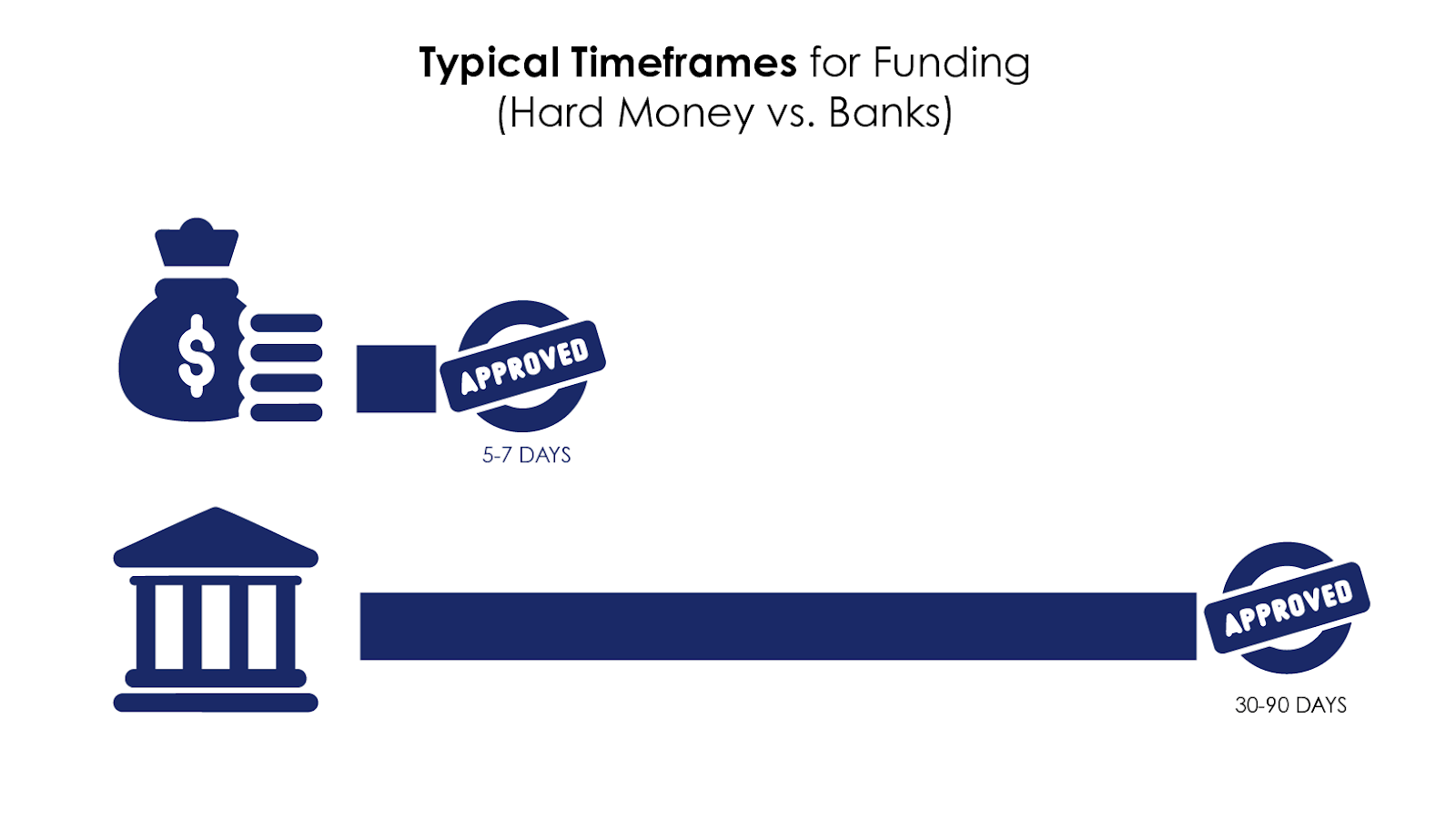

Banks and traditional monetary establishments often take 90 days or extra to shut a mortgage as a consequence of strict regulatory necessities and a tedious due diligence course of that have to be adhered to. A tough cash lender can usually fund a mortgage inside every week.

✓ Discount of Pink Tape and Paperwork Hassles

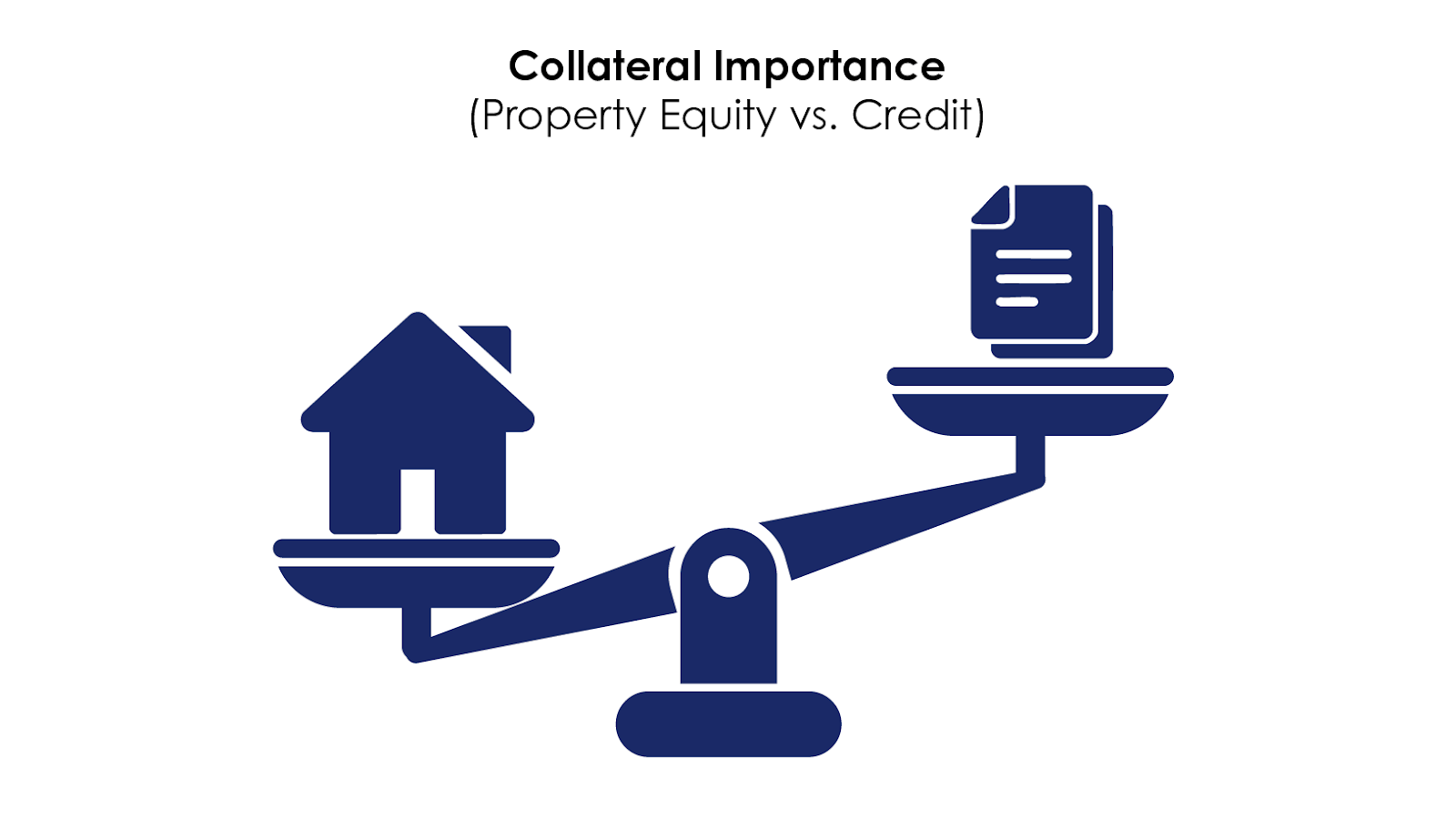

Conventional lenders require considerably extra documentation than non-public cash lenders and have extra stringent mortgage committee processes and pointers. Debtors should usually submit confidential monetary data and full an abundance of paperwork to search out out if a mortgage shall be permitted. A tough cash lender focuses primarily on one facet of the mortgage (collateral) whereas a financial institution will scrutinize the credit score, financials, job, and so forth. of a borrower.

✓ Flexibility and Artistic Downside Fixing

Non-public cash lenders are extra artistic with complicated mortgage conditions. They will provide choices like cross-collateralization of different properties, or provide extra versatile phrases than conventional lenders. The property might also have points that make it tough for typical lenders to finance equivalent to the necessity for enhancements to extend the occupancy of a constructing, or partially accomplished building, and so forth.

Moreover, conventional lenders won’t lend on uncooked land as a consequence of their strict underwriting pointers and are identified for limiting the quantity of funding properties a borrower can have of their portfolio.

✓ Return on Funding

Many debtors equivalent to builders, rental property buyers and property “flippers” have a selected purpose in thoughts when on the lookout for a loan- pace at which they will get their mortgage funded. These people are targeted on making a revenue and the simplicity and minimal time it takes with a non-public cash lender can far outweigh the upper price concerned for financing. Time is cash.

✓ Nature of the Mortgage and Market Situations

The fixed change in market situations and legal guidelines that govern the actual property market drive typical monetary establishments into taking much more time and have develop into much more conservative with approving loans. Non-public cash lenders alternatively have the power to evaluate the property or undertaking’s threat and cost an applicable charge for the perceived threat.

In essence, non-public cash lenders are fairness primarily based and an important part of the mortgage funding is the analysis of the actual property. A borrower’s previous historical past and degree of dedication performs an element in figuring out the viability of the mortgage however just isn’t as paramount to the choice making course of.

✓ Borrower Circumstances

Once more, these will not be simply restricted to credit score issues or a previous or present chapter as is most frequently assumed. There could also be tax liens or different liens that should be paid, or the property could also be getting into into foreclosures for a wide range of causes. The property could also be held up in probate, or concerned in a divorce or different household state of affairs. There could also be unemployment or a medical emergency.

The record is countless however the precept is mainly the identical; non-public cash lenders lend on the worth of the asset first, and the power of the borrower second. Finally, the choice resides with an skilled underwriter to judge the “entire story” when evaluating a possible borrower. Non-public cash is utilized by all kinds of debtors starting from very excessive web value people to classy actual property buyers and builders, all of whom desire the pace and ease of the mortgage course of.

There are quite a few the explanation why a borrower would search a tough cash mortgage. As a rule, it is because of not having the ability to qualify at a financial institution due to strict underwriting pointers.

The Mortgage Course of

Necessities

Relying on the kind of lender, the due diligence gadgets required from the borrower can range vastly. As an illustration, it’s well-known that banks or different typical lenders can require documentation that many of the common public really feel is “overkill” and tedious. As well as, conventional lending sources very often require paperwork, or updates, all the way in which as much as the precise closing of the mortgage.

Then again, a tough cash lender is well- identified for requiring a lot much less documentation and can usually solely want the knowledge to be offered at one time. Whereas a financial institution is trying carefully on the borrower (credit score, financials, and so forth.) and property being pledged as collateral for a mortgage, a tough cash lender is inserting the best emphasis on the fairness within the property.

Timeframes

Onerous cash lenders, due to their documentation necessities and fast underwriting course of, can usually fund loans in as little as 5-7 enterprise days. In some situations, a tough cash lender may even fund in a matter of hours.

As talked about earlier, with the myriad of necessities to qualify for a standard financial institution mortgage and the truth that there are a variety of people concerned within the mortgage approval course of, the everyday time to fund might be wherever from 30-90 days.

The principle distinction between a tough cash lender and a financial institution relies on the pace, flexibility and documentation required with the underwriting and funding of a mortgage.

Steps

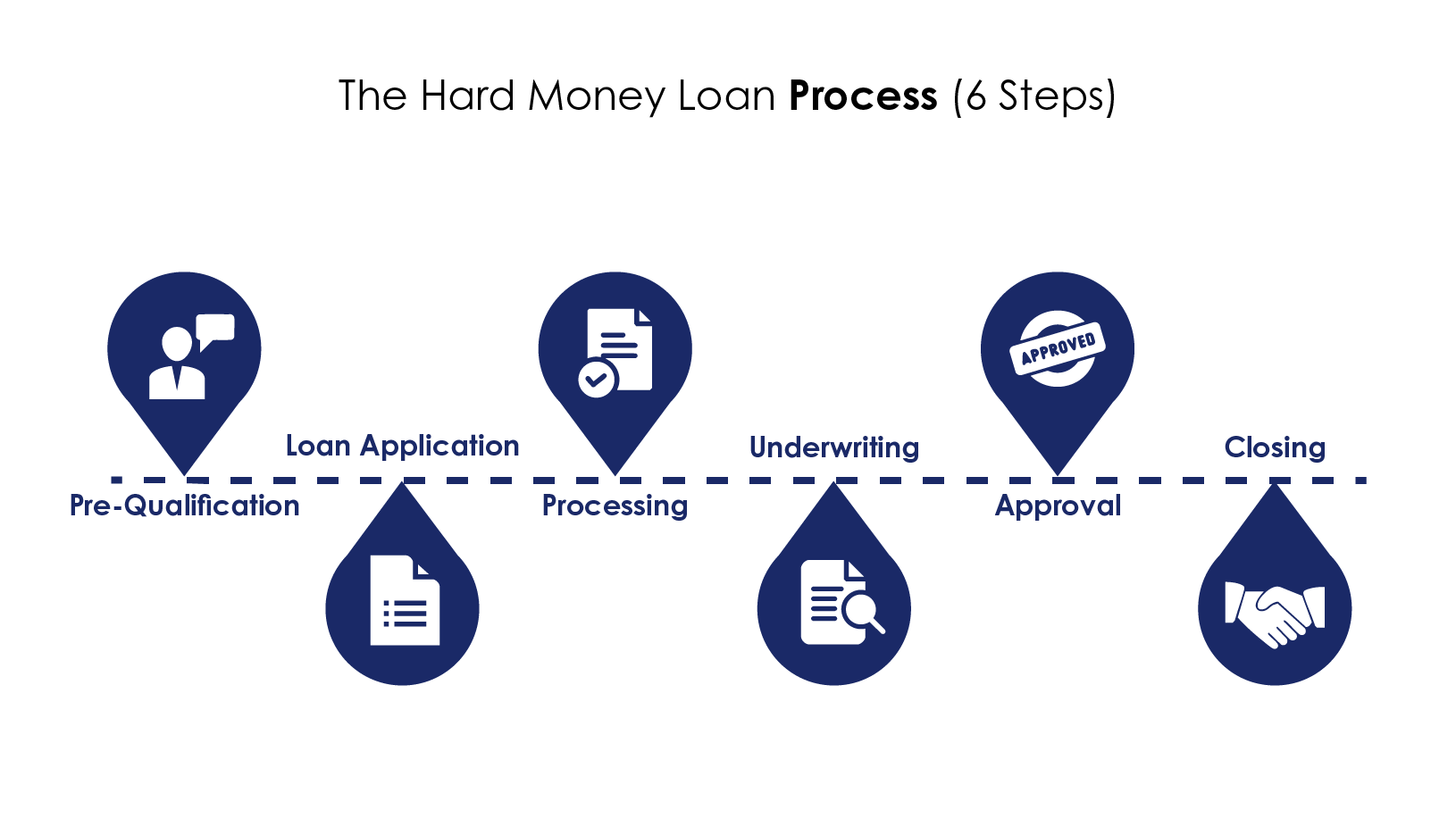

The steps concerned within the mortgage course of range vastly between a tough cash lender and a financial institution. Following is an inventory of the six main steps taken by a tough cash lender because it pertains to a residential (1-4 items) mortgage. Because it pertains to Supply Capital Funding, Inc., we will present an approval inside 24 hours and funding in a matter of days.

As well as, we’ll spotlight the variations on this course of as in comparison with a financial institution. The six steps embody Pre-Qualification, Mortgage Software, Processing, Underwriting, Approval and Closing.

1) Pre-Qualification

This happens earlier than the mortgage course of really begins, and is normally step one after preliminary contact is made. In a prequalification, the lender gathers details about the borrower and property getting used as collateral for the mortgage. The property itself is usually the one most vital issue when figuring out whether or not or to not transfer ahead within the mortgage course of. Different components, to a lesser diploma, embody borrower credit score and monetary stability.

2) Mortgage Software

The “software” is definitely the start of the mortgage course of and normally happens the identical day or following day after the Pre-Qualification. The borrower completes a mortgage software, authorization for lender to verify credit score, letter of rationalization and proof of revenue and employment and submits to lender for Processing.

Presently, all events must be clear as to what the mortgage request is and a stable understanding of what the borrower’s state of affairs is and the way the lender will help. You will need to notice that the lender is required to submit a Good Religion Estimate (GFE) and a Fact-In-Lending Assertion (TIL) to the borrower inside three days of receipt of a accomplished mortgage software. These paperwork assist the borrower perceive all prices related to the mortgage and phrases.

3) Processing

As soon as the mortgage software is accomplished, it’s assigned to a mortgage processor. It’s throughout this course of {that a} credit score report is ordered and an appraisal obtained on the topic property getting used as collateral for the mortgage. The mortgage processor’s predominant obligation is to make sure all of the paperwork submitted by the borrower are full and correct.

This contains verifying the borrower employment standing (W-2s and pay stubs), belongings (checking, financial savings, 401K, and so forth. accounts), and excellent money owed (bank cards, auto funds, pupil loans, and so forth.). Presently, if there are any points or questions relating to the knowledge offered, the processor will ask the borrower for added clarification and documentation. As soon as the processor has a whole bundle accomplished, he/she is going to undergo the underwriter to initialize the underwriting course of.

4) Underwriting

An underwriter’s predominant process is to evaluate the chance in a mortgage. Within the mortgage underwriting course of, an underwriter critiques or “underwrites” all elements of the mortgage from the borrower’s funds, employment and credit score to the actual property getting used as collateral. In brief, the underwriter is liable for figuring out whether or not the bundle submitted by the processor is deemed as a suitable mortgage for the lender’s portfolio.

Underwriters sometimes search for the next “3 Cs” to Underwriting:

- Collateral – What’s the worth and sort of property being pledged as collateral?

- Capacity – Does the borrower have the assets and means to debt service the mortgage and payoff at time period?

- Credit – Are there any points with the borrower’s credit score historical past?

For a tough cash underwriter, the main focus is predominantly primarily based on the collateral, as it’s the single, most vital merchandise that secures the mortgage. The flexibility to repay (capability) and the credit score historical past (credit score) of a borrower are vital however just isn’t what gives the lender essentially the most safety; the fairness within the property is paramount. Sadly for a borrower, jobs, monetary state of affairs, life occasions (marriage, divorce, delivery, demise, and so forth.) can change in a fashion of minutes and all these components can have a major impression on the mortgage.

Traditionally, actual property values do not need the moment volatility as a borrower would and thus, the values are weighted extra closely than a borrower’s revenue, job, and so forth. In summation, an underwriter needs to verify a mortgage quantity doesn’t exceed a property’s worth. In any other case, a lender could not have the ability to recuperate a mortgage’s unpaid stability, within the case of default.

The fairness within the property getting used as collateral for a mortgage is an important issue to a tough cash lender.

5) Approval

If permitted, the lender will ship the borrower a dedication letter. This letter outlines all phrases and situations for the mortgage and the borrower shall be given a set period of time to simply accept the provide. If the phrases are agreed upon by the borrower, the lender could ask for a number of further gadgets from the borrower together with, however not restricted to, proof of hazard insurance coverage, any HOA data, payoff calls for from different collectors, property tax data and title and escrow contacts (if not opened already).

6) Closing

The closing course of includes three events – the borrower, lender and escrow agent. Every occasion has a selected position. For the borrower, closing is synonymous with signing mortgage paperwork. Throughout this time, the borrower must evaluation, signal and date quite a few authorized paperwork. Whereas this course of could appear tedious and redundant, it’s needed to guard all events.

The lender is liable for sending all mortgage paperwork to the escrow agent to rearrange for the borrower to signal and for wiring the mortgage proceeds to the escrow agent for supply to the borrower.

Take into account that the lender has labored instantly with the borrower all through the mortgage course of and is intimate with all particulars relating to the mortgage so the mortgage paperwork are sometimes error free, thus saving beneficial time. The escrow agent is liable for guaranteeing the borrower correctly executes all the mandatory mortgage paperwork required by legislation in addition to working with a title agent to safe a title insurance coverage coverage.

As soon as the mortgage paperwork have been signed by the borrower, the escrow agent sends the unique paperwork to the lender (apart from the Deed of Belief) and the lender wires funds to the escrow agent. Crucial step on this course of is for the escrow agent to document the Deed of Belief (mortgage) with the County Recorder during which the property is positioned. The recordation if this doc gives public discover that there’s a lien (mortgage) on the property. As soon as the Deed is recorded, the funds are launched to the borrower and the mortgage is closed.

At closing there are sometimes three events (borrower, lender and escrow agent) and every has a selected position that they have to fulfill.

Benefits of Utilizing Supply Capital Funding, Inc.

There are a myriad of personal lenders, people and entities that present loans secured by actual property. Like several enterprise, some are good and a few will not be; however how are you aware? What separates a superb lender from the remainder? Price is at all times a priority for a borrower and the rate of interest and charge charged is a major issue.

Nevertheless, it’s crucial for one to contemplate that the lender, as soon as the mortgage is funded, will place a lien in your property and shall be “tied” to a borrower all through the time period of the mortgage. It’s of utmost significance for a borrower to know what they’re entering into and with whom.

As a state and federally licensed direct lender, Supply Capital Funding, Inc. gives:

- Expertise – Since 2006, Supply Capital Funding, Inc. has underwritten over $1.4B in loans secured by actual property. From residential and business properties to lot and land financing, the agency has the underwriting data and funding capabilities to shut loans.

- Integrity – Integrity is a singular mix of confirmed honesty and moral enterprise rules which might be earned over time. As a Higher Enterprise Bureau member since 2007, the corporate has earned the distinguished “A+ Ranking” for its sound enterprise practices. Status – From debtors to brokers and buyers, Supply Capital has acquired quite a few testimonials by mail, electronic mail and Web critiques. We’re happy with our impeccable repute with our shoppers and know that the relationships constructed will final a lifetime.

- Transparency – We consider in full disclosure and educating our shoppers. Supply Capital ensures that the expectations of its shoppers are met by speaking all particulars of the mortgage course of, irrespective of how small, so as to guarantee readability. The agency gives all vital particulars in writing from begin to end to make sure readability and save beneficial time.

- Buyer Service – From the infancy levels of an preliminary name with a consumer till the mortgage is funded, Supply Capital is intimately concerned within the course of. It will be important that shoppers perceive that we’re right here to assist and can be found any day throughout the week to perform this.

- Truthful Phrases – Supply Capital believes in providing its shoppers an rate of interest and mortgage they will afford whereas permitting for the power to pay again a mortgage at any time. We’ve got no prepayment penalties or “junk charges” related to our loans and provide market fee rates of interest