Many metro Denver tenants paid greater than $1,600 in extra lease in 2023 due to a profit-maximizing algorithm that Colorado lawmakers unsuccessfully tried to ban earlier this yr, in response to a brand new report issued by the White Home. How correct is that this info? Is there a obvious flaw on this evaluation? Why are Denver rents actually increased, trace it has nothing to do with software program

What was within the evaluation on Denver rents?

The White Home’s Council of Financial Advisers discovered that American tenants who reside in flats that use the algorithm paid $70 extra per 30 days, on common, than different renters. Final yr, its use price renters an extra $3.8 billion, a determine that the report says is probably going a “decrease” estimate of the true price ticket. The algorithm, owned by software program developer RealPage, helps landlords decide rents — and, critics have alleged, coordinate pricing between them, amounting to cost fixing.

The toll was excessive in Denver: Of the 20 main American metropolitan areas examined within the report, tenants in metro Denver shouldered the second-highest additional price every month of RealPage’s algorithm: $136 on common, behind solely Atlanta’s $181.

Elementary flaw within the evaluation on Denver rents

The research is biased to say the least; the writer of the research is the Biden administration that can be suing Actual Web page over AI pricing. Lengthy and brief this information is a advertising and marketing piece for his or her lawsuit. Moreover there’s a elementary flaw within the evaluation, the place they’re complicated the true causation of the upper rents.

For instance, the businesses utilizing AI software program aren’t the mother and pop condo house owners. They’re massive nationwide corporations. These massive condo house owners are providing totally different merchandise than somebody who is just not utilizing AI. For instance, the customers of the software program might be specializing in newer models, increased or decrease priced models, and so forth…. Lengthy and brief the software program is just not inflicting rents to be increased, the actual root trigger is all these different components and has nothing to do with the software program. It’s unhappy that the US authorities is pumping out this jaded research as reality with out questioning the deserves of the information.

Under I’ll get into the small print of the 4 drivers of upper rents in Denver and none of them are software program associated.

Is AI actually inflicting increased rents?

Everyone knows rents have elevated, however the cause appears to be alluding our elected officers. The brand new scapegoat for rising rents is being pinned on synthetic intelligence as the foundation explanation for excessive rents. Why is the federal government now going after a software program firm to decrease rents? Is one software program firm actually the foundation explanation for inflation? What are the 4 actual causes for housing inflation?

The Biden administration has a brand new scapegoat for prime rental prices, one software program firm known as Actual Web page that gives pricing info to massive condo house owners. The Justice Division Justice claims RealPage allows landlords to conspire to lift rents. It seems to be like Trump will proceed this struggle to try to accomplish decrease rents that are a main explanation for inflation.

In actuality, RealPage’s instruments resemble applied sciences that many companies use to regulate costs primarily based on adjustments in buyer demand, market provide and competitor costs. Such algorithms enhance worth discovery and make markets extra environment friendly.

Who’s RealPage?

RealPage gathers information from landlords about condo emptiness charges, predicted future occupancy, rental costs, executed leases and their phrases. It trains an AI mannequin on this information to counsel rents to landlords that replicate market circumstances to maximise their revenue. Charging an excessive amount of may end up in vacancies. Charging too little leaves cash on the desk.

RealPage collects info on about 16 million of the 50 million or so rental models nationwide. However solely landlords with about three million models use its instruments. Justice says RealPage’s penetration in some “submarkets” can vary from 29% to greater than 60%. However the authorities doesn’t furnish proof that rents have elevated extra in these markets.

What about corporations like Zillow?

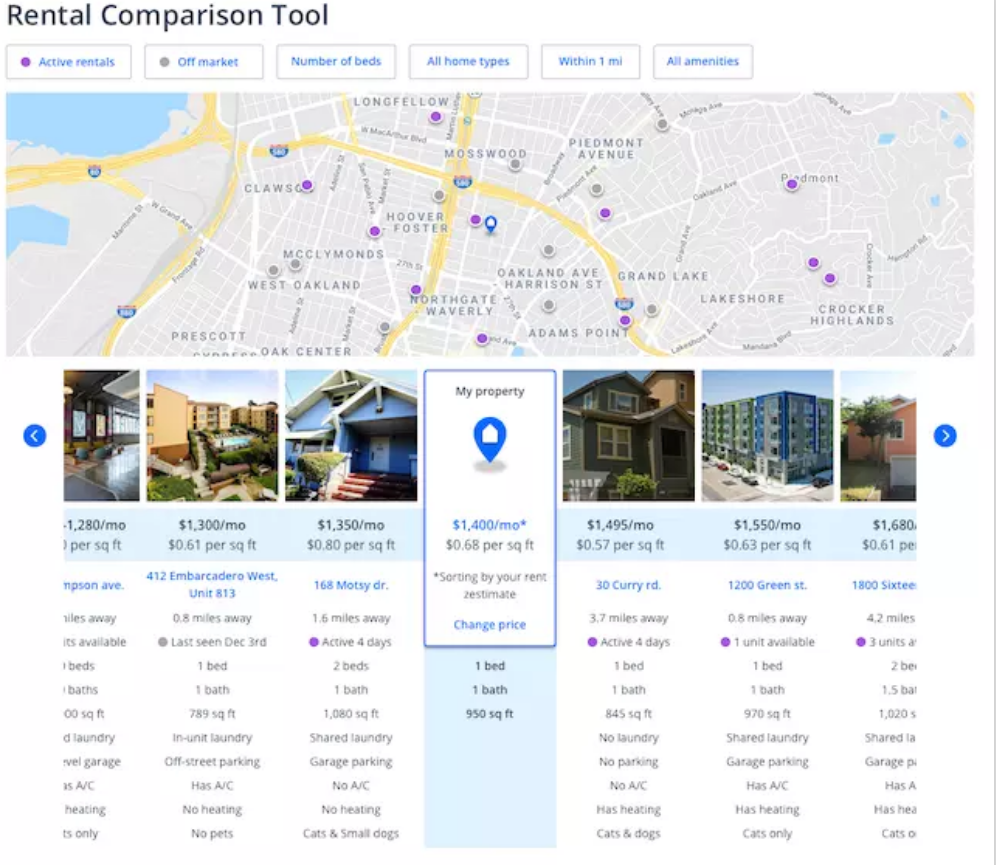

Zillow supplies comparable pricing info as Actual Web page. You possibly can search for any property and see what each different property is listed for lease after which it suggests what it’s best to lease your property for. In case you pay for the premium product you get much more details about rivals rents. That is similar to what actual web page does simply on a bigger scale and certain with extra detailed info

Observe, I’ve no canine on this struggle with both the fed or actual web page. With that stated, it’s a stretch to say the Actual Web page is violating any antitrust legal guidelines as there is no such thing as a collusion with different events to set costs. The software program merely suggests what worth they predict the market will enable and property house owners can do what they need with the knowledge. That is similar to what number of use the knowledge on Zillow as a suggestion of pricing not a requirement.

Slippery slope concentrating on corporations counting on information for pricing selections

It’s a very slippery slope to start out concentrating on corporations counting on AI fashions for pricing. Each main firm from ski resorts to Disneyworld use pricing fashions to find out the optimum costs. Consider Airways, who’re one of many early adopters of demand-based pricing. Through the holidays flights price extra, each airline is utilizing a mannequin that appears at demand together with competitor costs to find out the optimum worth. For instance, on a scorching route like Atlanta to Denver there’s extra competitors, and pricing will likely be lower than on a flight from Atlanta to Aspen the place there’s significantly much less competitors and big demand. That is fundamental enterprise resolution making utilizing the very best information accessible. The Fed going after one firm for making a pricing mannequin is a nasty coverage and can ensnare 1000’s of different companies.

What are root causes of housing inflation in Denver

A pricing mannequin is just not even on the highest 10 checklist of the reason why rental costs are going up. At present there’s a mismatch, particularly on the cheaper models, between demand and provide. Take Denver for instance, rents have elevated considerably as builders aren’t constructing reasonably priced rental properties that aren’t authorities backed as a result of excessive price of constructing. So what actually is inflicting rents to skyrocket

- Mismatch in housing location vs demand: There may be tons of demand in a metropolis like Denver versus Pueblo, but there’s a ton of availability at a lot lower cost factors in Pueblo, but individuals nonetheless wish to be in Denver. Lengthy and brief there’s a mismatch in places of decrease prices and demand. The largest examples are within the Colorado ski cities, consider home costs and in flip lease costs in Craig, CO vs. Steamboat Springs.

- Value of capital to construct: As rates of interest have elevated and financing has dried up, the price to construct flats and rental models has skyrocketed resulting in considerably much less constructing. That is additional exacerbating provide points.

- Constructing prices: Labor, Materials, land prices have all elevated making it subsequent to not possible to construct price efficient models particularly in areas the place demand for price efficient models has surged.

- Governmental laws: Whether or not it’s affect charges, power effectivity necessities, all electrical necessities, and so forth… all of those adjustments have elevated the price to construct considerably. Denver is the poster little one for elevated laws. This additional makes it subsequent to not possible to construct market charge reasonably priced housing models.

Abstract

Pinning excessive rents in Denver on an AI mannequin is laughable and additional concentrating on one software program firm for creating an AI mannequin to assist higher worth leases is totally ludicrous. Pc fashions have enabled companies throughout the financial spectrum to be extra environment friendly by optimizing their costs.

Consider Vail resorts, costs are increased on the ticket workplace over Christmas than on a random non vacation Monday. The explanation Vail does that is to each handle demand and optimize revenue. AI fashions allow the rental trade to turn out to be extra environment friendly by managing demand and provide. On the finish of the day, whether or not Realpage is the info provider or Zillow or another person, this info is already accessible and corporations will proceed to automate their pricing of rental models. Prohibiting corporations from utilizing AI pricing fashions is a slippery slope that may ensnare each main firm.

Moreover, it’s disappointing that our federal authorities and Colorado state authorities is losing a lot time and assets attempting to pin housing inflation on pricing fashions versus truly working to mitigate the actual drivers of housing inflation. I’ve not seen a single proposal out of the Colorado statehouse or main cities like Denver that will decrease the price of constructing, mockingly all their proposals are doing the other making it increasingly more tough to construct price environment friendly rental models.

Further Studying/Assets:

We’re a Non-public/ Exhausting Cash Lender funding in money!

Glen Weinberg personally writes these weekly actual property blogs primarily based on his actual property expertise as a lender and property proprietor. I’m not an armchair reporter/author. We’re an precise personal lender, lending our personal cash. We service our personal loans and personal industrial and residential actual property all through the nation.

My day job is and continues to be personal actual property lending/ arduous cash lending which allows me to have a singular perspective available on the market. I don’t settle for any paid sponsorships or advertisements on my weblog to make sure correct info. I’ve been scripting this for nearly 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, fb, and different social media and ahead to your mates . I might significantly respect it.

Fairview is a arduous cash lender specializing in personal cash loans / non-bank actual property loans in Georgia, Colorado, and Florida. We’re acknowledged within the trade because the chief in arduous cash lending/ Non-public Lending with no upfront charges or another video games. We fund our personal loans and supply trustworthy solutions shortly. Be taught extra about Exhausting Cash Lending via our free Exhausting Cash Information. To get began on a mortgage all we’d like is our easy one web page utility (no upfront charges or different video games).

Written by Glen Weinberg, COO/ VP Fairview Business Lending. Glen has been printed as an knowledgeable in arduous cash lending, actual property valuation, financing, and varied different actual property matters in Bloomberg, Businessweek ,the Colorado Actual Property Journal, Nationwide Affiliation of Realtors Journal, The Actual Deal actual property information, the CO Biz Journal, The Denver Publish, The Scotsman mortgage dealer information, Mortgage Skilled America and varied different nationwide publications.

Tags: Exhausting Cash Lender, Non-public lender, Denver arduous cash, Georgia arduous cash, Colorado arduous cash, Atlanta arduous cash, Florida arduous cash, Colorado personal lender, Georgia personal lender, Non-public actual property loans, Exhausting cash loans, Non-public actual property mortgage, Exhausting cash mortgage lender, residential arduous cash loans, industrial arduous cash loans, personal mortgage lender, personal actual property lender