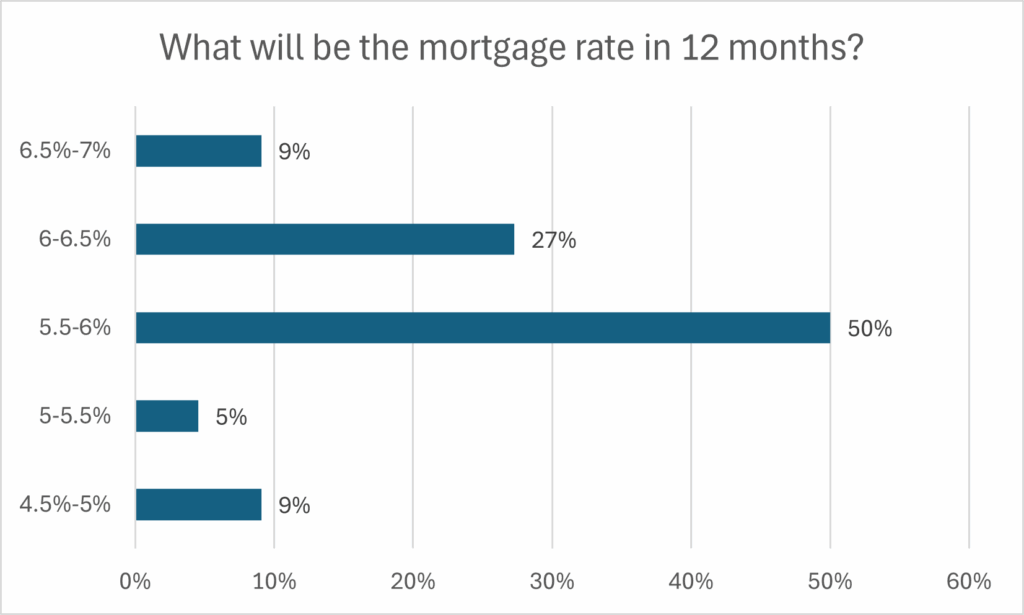

Final week I requested all of you what’s going to mortgage be one 12 months from now? The actual property execs have spoken and as you’ll be able to see from the chart above, the bulk (50%) suppose that mortgage charges might be 5.5 -6% whereas the second largest share put charges within the 6-6.5% vary. How correct are these predictions?

What did actual property execs say about mortgage charges one 12 months from now?

I used to be fairly stunned that 77% put mortgage charges within the 5.5% to six.5% vary. In case you take a look at skilled forecasters from Wells Fargo, Fannie Mae, and so forth.. they’re all inside this vary as effectively. It looks as if a fairly secure guess based mostly on this survey that charges might be north of 5.5%, simply how a lot additional is the query.

Personally I feel charges will keep a bit increased than predicted with charges from about 6.5 to 7% based mostly on authorities spending and continued inflation pressures.

Key insights on Mortgage charges within the upcoming 12 months

Thanks everybody to your participation and insights in my survey. The perception within the feedback from readers was wonderful and I hope everybody gained a superb perspective out of your fellow readers. My key takeaway from this survey is that mortgage charges are going to remain increased for for much longer than anticipated and only a few suppose they are going to fall again to pandemic lows as there’s a a lot better tilt in the direction of increased charges. Excessive charges are going to proceed to have large impacts on residential and business actual property with a lot decrease volumes and impacts on costs. Thanks once more and keep tuned for upcoming surveys

Extra Studying/Assets:

- https://www.fairviewlending.com/fed-drops-rates-why-did-mortgage-rates-barely-budge/

- https://www.fairviewlending.com/phantom-debt-soars-what-does-this-mean-for-real-estate-2/

- https://www.fairviewlending.com/never-buy-a-residential-condo/

- https://www.fairviewlending.com/the-war-on-landlords/

- https://www.fairviewlending.com/house-prices-hit-another-record-should-you-even-care/

- https://www.fairviewlending.com/root-cause-of-real-estate-price-declines/

- https://www.fairviewlending.com/will-real-estate-fall-to-2020-values/

We’re a Personal/ Onerous Cash Lender funding in money!

In case you have been forwarded this message, please subscribe to our e-newsletter

Glen Weinberg personally writes these weekly actual property blogs based mostly on his actual property expertise as a lender and property proprietor. I’m not an armchair reporter/author. We’re an precise non-public lender, lending our personal cash. We service our personal loans and personal business and residential actual property all through the nation.

My day job is and continues to be non-public actual property lending/ onerous cash lending which permits me to have a singular perspective available on the market. I don’t settle for any paid sponsorships or advertisements on my weblog to make sure correct data. I’ve been scripting this for nearly 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, fb, and different social media and ahead to your pals . I’d vastly recognize it.

Fairview is a onerous cash lender specializing in non-public cash loans / non-bank actual property loans in Georgia, Colorado, and Florida. We’re acknowledged within the business because the chief in onerous cash lending/ Personal Lending with no upfront charges or some other video games. We fund our personal loans and supply trustworthy solutions shortly. Study extra about Onerous Cash Lending by our free Onerous Cash Information. To get began on a mortgage all we want is our easy one web page utility (no upfront charges or different video games).

Written by Glen Weinberg, COO/ VP Fairview Business Lending. Glen has been revealed as an knowledgeable in onerous cash lending, actual property valuation, financing, and numerous different actual property matters in Bloomberg, Businessweek ,the Colorado Actual Property Journal, Nationwide Affiliation of Realtors Journal, The Actual Deal actual property information, the CO Biz Journal, The Denver Submit, The Scotsman mortgage dealer information, Mortgage Skilled America and numerous different nationwide publications.

Tags: Onerous Cash Lender, Personal lender, Denver onerous cash, Georgia onerous cash, Colorado onerous cash, Atlanta onerous cash, Florida onerous cash, Colorado non-public lender, Georgia non-public lender, Personal actual property loans, Onerous cash loans, Personal actual property mortgage, Onerous cash mortgage lender, residential onerous cash loans, business onerous cash loans, non-public mortgage lender, non-public actual property lender, residential onerous cash lender, business onerous cash lender, No doc actual property lender