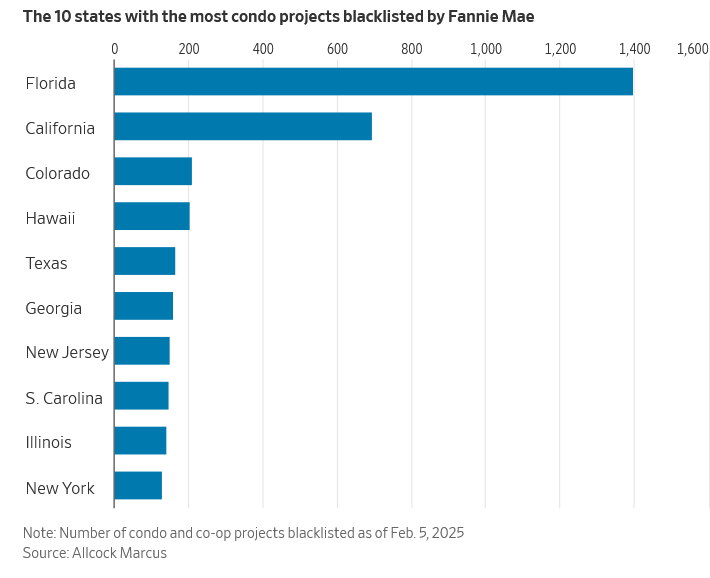

Condominium house owners throughout the nation are dealing with a paralyzing downside: They’ll’t promote their properties due to a fast-growing and largely secret mortgage blacklist. Don’t fear this isn’t some loopy conspiracy from the federal government. I’ve skilled this primary hand on a number of condos in Georgia, Colorado, and Florida. What’s inflicting the spike in “blacklisted” condos? How do properties get on the blacklist and might they get off the checklist? What does this imply for apartment costs? What must you do?

What was within the knowledge on blacklisted condos?

The blacklist is maintained by Fannie Mae and contains apartment associations that the mortgage finance large thinks don’t have sufficient property insurance coverage or have to make essential constructing repairs. Being on the checklist could make it tougher for potential patrons to get a mortgage.

The variety of properties that fail to satisfy Fannie Mae’s requirements has risen to five,175 this month from a number of hundred earlier than the Surfside apartment collapse in Florida.

Why the massive change in variety of blacklisted condos?

Fannie Mae and sister group Freddie Mac don’t make loans, however purchase roughly half of the nation’s dwelling loans from lenders and bundle them to promote to traders, then assure funds on them. Loans that meet Fannie or Freddie’s underwriting requirements, referred to as conforming loans, could be cheaper and require decrease down funds than different mortgages.

To make sure the debt could be repaid ought to the property be broken or destroyed, Fannie and Freddie have lengthy required a minimal degree of insurance coverage protection for dwelling loans they’re prepared to purchase.

Final yr, the corporations issued clarifications of those pointers, detailing coverage no-nos which have prompted lenders to take a stricter line on insurance coverage necessities, in accordance with lenders, real-estate brokers and insurers.

A spokeswoman for Fannie mentioned its necessities are designed to “assist defend debtors from bodily unsafe or financially unstable tasks.” She disagreed with characterizing Fannie’s database of tasks, which incorporates properties that each do and don’t meet its lending standards, as a blacklist. She mentioned the agency supplies a web based device that permits lenders to verify whether or not it accepts loans from a given mission.

What two elements led to Condos getting on the blacklist?

There are two elements Fannie/Freddie have a look at to find out if a apartment is appropriate for financing:

- Upkeep/Reserves: After the apartment collapse in FL a number of years in the past and new legal guidelines in lots of states, many complexes have discovered themselves severely underfunded for routine upkeep and anticipated bills for roofs, foundations, elevators, hvac, and so forth…

- Insurance coverage: Many apartment complexes don’t carry full alternative value on insurance coverage as required by Fannie/Freddie. One purpose for the bounce in insurance coverage prices: Insurers now wish to pay for the depreciated worth of a broken roof, fairly than the complete alternative value, a characteristic Fannie and Freddie oppose. Many insurers additionally wish to elevate deductibles larger than Fannie or Freddie enable.

- Numerous associations are attempting to scale back hovering insurance coverage charges by agreeing to pared-down insurance policies that may make their condos ineligible for mortgages backed by Fannie and Freddie. Some householders’ gross sales are falling by means of, and others are in search of patrons who will pay money or get different forms of loans.

- Shadow Ridge, a Los Angeles complicated blacklisted in December, is in a brushfire zone however escaped this yr’s infernos. Its home-owner’s affiliation was lately quoted $2.6 million a yr for a Fannie-compliant coverage, 10 occasions the present fee, in accordance with Jinah Kim, one of many board members.

What occurs when a apartment mission is on the blacklist?

I’ve seen a number of situations play out for condos which can be unable to get typical financing from Fannie/Freddie:

- Improve down cost: I’ve seen a number of events the place a lender would settle for the mortgage with a down cost of 30-35% versus 20% or much less relying on the lender. The difficulty is most of the complexes which have points are inexpensive and debtors can’t afford a 35% down cost or they might be taking a look at a home or different property.

- Discover one other lender with larger charges: On a number of events I’ve seen different lenders capable of step in to finance albeit at larger charges.

- Can’t get financing: Some condos are unable to get financing at any degree which ends up in all money gross sales

No matter which state of affairs above performs out, every one results in a lot decrease resale values. I’ve seen costs drop from 10% to nearly 40% if it needs to be an all money buy. If you happen to personal a apartment or are taking a look at a apartment in a blacklisted complicated financing shall be tougher and or may very well be non existent.

Can condos get off the Fannie/Freddie blacklist?

Sure, condos can get off the blacklist, however typically the prices are so excessive that they aren’t prepared to pay the premium. I used to be taking a look at a apartment in Colorado and the HOA dues would want to triple every month for the brand new insurance coverage coverage. On the flip aspect, in lots of complexes with deferred upkeep they require a particular evaluation that may run within the 1000’s or tons of of 1000’s. On a latest transaction, a fancy had a 50k particular evaluation and the unit was solely value 200k. The numbers made no sense.

Why is Colorado quantity three on the mortgage blacklist?

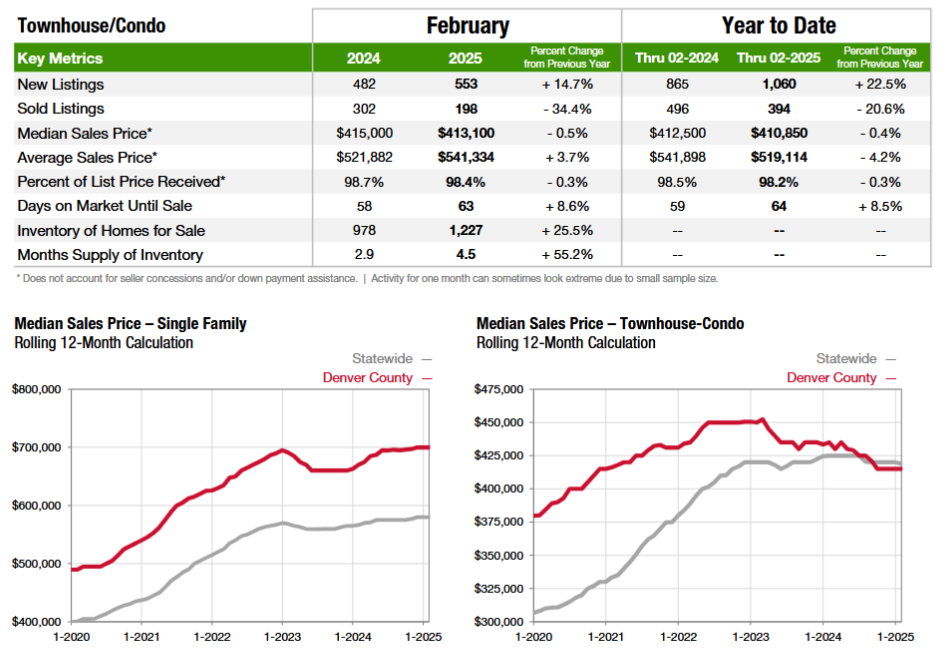

I used to be shocked to see Colorado on the checklist, however after fascinated about it extra, it isn’t actually shocking. Colorado has one of many highest charges of claims for hail. Because of this, insurance coverage prices have risen exponentially within the metro space. Many complexes can not take up the price of the insurance coverage will increase, and their house owners are pushing for value efficient choices like carrying larger deductibles or not getting full alternative prices. These selections are making many apartment complexes ineligible for Fannie/Freddie loans. We are able to see this taking part in out within the knowledge above the place stock is rising on condos in Denver and costs are falling versus costs holding regular on single household properties.

How will apartment costs be impacted by the mortgage blacklist?

You’ll want to be extraordinarily cautious shopping for in a apartment complicated particularly a really massive multi story constructing that’s older. Many older and bigger complexes won’t qualify for typical financing on account of deferred upkeep and excessive insurance coverage prices which can finally drive costs down considerably.

Simply originally of the mortgage blacklist impacts

I’m really shocked it has taken Fannie and Freddie this lengthy to comprehend the issues brewing within the apartment market. Over the past 20 years 1000’s of complexes have saved cash deferring costly upkeep and shopping for decrease value insurance coverage insurance policies, however as we will see they’re now paying the value.

Though I’m settlement with Fannie/Freddie on the upkeep classification of properties, the insurance coverage points have gotten uncontrolled. Many decrease priced properties are in a troublesome spot as they’re unable to lift dues excessive sufficient to cowl the elevated prices which can finally result in an enormous drop in values in lots of older and cheaper apartment models. No matter whether or not Fannie is correct or unsuitable doesn’t actually matter as on the finish of the day property house owners and potential patrons are caught up within the aftermath and have to be cautious.

Extra Studying/Assets:

- https://www.fairviewlending.com/property-insurance-rates-set-to-jump-by-50-why-and-who-pays/

- https://coloradohardmoney.com/condo-prices-fall-throughout-colorado/

- https://www.wsj.com/finance/regulation/condo-sales-home-insurance-crisis-a921362b?mod=mhp

We’re a Non-public/ Onerous Cash Lender funding in money!

Glen Weinberg personally writes these weekly actual property blogs primarily based on his actual property expertise as a lender and property proprietor. I’m not an armchair reporter/author. We’re an precise personal lender, lending our personal cash. We service our personal loans and personal industrial and residential actual property all through the nation.

My day job is and continues to be personal actual property lending/ arduous cash lending which permits me to have a novel perspective in the marketplace. I don’t settle for any paid sponsorships or adverts on my weblog to make sure correct info. I’ve been scripting this for nearly 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, fb, and different social media and ahead to your mates . I might significantly recognize it.

Fairview is a arduous cash lender specializing in personal cash loans / non-bank actual property loans in Georgia, Colorado, and Florida. We’re acknowledged within the business because the chief in arduous cash lending/ Non-public Lending with no upfront charges or some other video games. We fund our personal loans and supply sincere solutions rapidly. Study extra about Onerous Cash Lending by means of our free Onerous Cash Information. To get began on a mortgage all we want is our easy one web page utility (no upfront charges or different video games).

Written by Glen Weinberg, COO/ VP Fairview Industrial Lending. Glen has been revealed as an knowledgeable in arduous cash lending, actual property valuation, financing, and numerous different actual property subjects in Bloomberg, Businessweek ,the Colorado Actual Property Journal, Nationwide Affiliation of Realtors Journal, The Actual Deal actual property information, the CO Biz Journal, The Denver Submit, The Scotsman mortgage dealer information, Mortgage Skilled America and numerous different nationwide publications.

Tags: Onerous Cash Lender, Non-public lender, Denver arduous cash, Georgia arduous cash, Colorado arduous cash, Atlanta arduous cash, Florida arduous cash, Colorado personal lender, Georgia personal lender, Non-public actual property loans, Onerous cash loans, Non-public actual property mortgage, Onerous cash mortgage lender, residential arduous cash loans, industrial arduous cash loans, personal mortgage lender, personal actual property lender, residential arduous cash lender, industrial arduous cash lender, No doc actual property lender