Two excessive finish Colorado ski cities are taking radically totally different stances on tourism. Vail had proposed a 17% quick time period rental gross sales tax, whereas Steamboat is taking the other method by proposing to tax vacant properties. Which resolution is appropriate? What does each imply for actual property costs? What’s a 3rd resolution that may be higher?

Why are Colorado ski cities so adamant about growing taxes?

I’ve written in previous blogs about how tourism in Colorado ski cities shouldn’t be paying its personal approach. Basically the rise in tourism is main to large finances shortfalls that should be made up in some way. Couple the income points with spending sprees in most Colorado ski cities and now we have the difficulty we are actually dealing with. The cash has to come back from someplace and Vail and Steamboat are taking two radically totally different approaches to taxation to extend revenues.

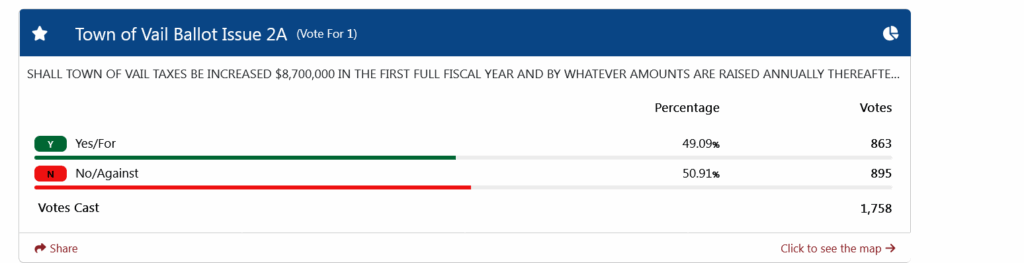

The Vail resolution of 17% tax on quick time period rental stays

Vail had proposed a further 6% tax on short-term rental stays resulting in a 16.8% whole tax on nightly rental stays. This is likely one of the highest in Colorado

Execs: will make tourism pay its fair proportion with taxes used to fund inexpensive housing, and many others…

Cons: Will doubtless not herald close to the sum of money they assume as now we have seen in Breckenridge and different cities the issue merely strikes. For instance when Breckenridge elevated nightly rental laws, now extra leases acquired pushed by way of to Frisco, Copper, Silverthorne, Keystone, and many others… which didn’t actually remedy the difficulty. Within the case of Vail, you will note extra leases in non vail areas and locations like Copper the place you may commute into Vail so the issue of nightly leases will merely transfer to different areas. Paradoxically what we noticed in Breckenridge is that home costs shot up in as soon as inexpensive areas like Copper Mountain that used to accommodate locals; these models had been both bought or moved into nightly leases as demand elevated a lot.

The Steamboat resolution of taxing vacant properties

Steamboat has proposed a vacant dwelling tax to tax second owners 3100/yr if the property is used lower than 183 days a yr by the proprietor or a tenant. Though the vacant dwelling tax didn’t make it on the poll this yr, many councilors are nonetheless on the vacant tax bandwagon so search for it to come back up for vote once more quickly.

Execs: Constant income for town, however the prices will far outweigh any tax profit.

Cons: Steamboat is lacking a primary financial precept, a vacant dwelling is definitely the most effective factor for a neighborhood, particularly costly properties. Roads, sewer, and many others… are sunk prices that should be maintained whether or not individuals are within the homes or not. People who find themselves leaving their homes vacant and solely utilizing them for a month or so are superior for communities as they supply considerably extra in taxes than they use in providers versus rental homes. The one that solely makes use of the home for 30 days or so a yr remains to be going out to eat, shopping for furnishings, paying utility payments, in lots of instances donating to native causes, and many others… They’re the perfect candidate for what you need in a excessive finish ski city

Silverthorne resolution: affect charges

One strategy to attempt to break the cycle of elevated prices vs tourism is to create affect charges in order that new demand for providers really pays for itself and doesn’t set cities up for the present Ponzi scheme. Silverthorne hearth tried to introduce affect charges:

Examples of the utmost charges proposed embrace: a $1,084 price for properties sized between 1,001 sq. toes to 2,000 sq. toes; a $3,961 price per 1,000 sq. toes for brand spanking new retail developments; a $2,198 price per 1,000 sq. toes for workplace area improvement; and a $7,507 price per 1,000 sq. toes for institutional developments.

Execs: Ties development in providers with improvement in order that new calls for for providers pay their very own approach

Cons: It would gradual development down, lots of the metropolis councils are so involved with the income quantity versus the profitability quantity that these proposals hardly ever get off the bottom.

What’s the finest resolution for fixing the tourism and housing points in CO ski cities?

Sadly all three proposals in Vail, Steamboat, and Silverthorne had been defeated so we don’t have actual world knowledge to see which might be the most effective resolution. Regardless, the most effective resolution is for ski cities to drastically cut back spending in order that taxes don’t have to repeatedly be raised. Moreover, ski cities have to be extra artistic with inexpensive housing. For instance in Steamboat as a substitute of spending 50 million on a brand new subdivision with questionable soils, why not for half that quantity construct a subdivision in Craig or purchase present properties in Craig for a 3rd of the associated fee?

As soon as bills of ski cities are introduced in line and inexpensive housing has a logical plan taxes might be carried out to assist. Of the three proposed, I believe the most effective resolution is affect charges that tie development in providers to bills. Silverthorne tried and failed however this must be the highest instrument in ski cities.

Subsequent a brief time period rental tax can also be a part of the tax combine if completed accurately. It must be completed county huge and distributed again to the cities the place the tax is collected (or a proportion). For instance for Eagle county perhaps an 8-10% quick time period rental tax county huge (or no matter is set to be the suitable quantity) versus 6% in unincorporated areas and 17% in vail.

The emptiness tax is the worst thought as the prices from alienating second dwelling house owners shouldn’t be value any income acquire. The rich second dwelling house owners present enormous advantages by paying the identical taxes as locals and but not utilizing the providers like faculties, and many others… Leaving homes vacant ought to really be inspired to assist with the tourism subject many ski cities are dealing with.

Sadly there’s not a single ski city that’s dealing with tourism accurately. It will likely be fascinating to see how the varied taxes play out over the subsequent a number of years and what the precise outcomes are. No matter which finally ends up the proper resolution, I’m keen to guess a ton of cash that three years from now even with the elevated taxes we are going to nonetheless be having heated discussions about tourism, housing, spending, and many others… as no ski city is taking a complete method and making the onerous selections to steadiness the competing pursuits.

Further Studying/Assets

- https://coloradohardmoney.com/are-colorado-ski-towns-running-a-pyramid-scheme/

- https://coloradohardmoney.com/colorado-vacancy-tax/

- 7 Colorado counties asking voters to boost lodging taxes to pay payments

We’re a Colorado Non-public/ Arduous Cash Lender funding in money!

In case you had been forwarded this message, please subscribe to our e-newsletter

I want your assist as my purpose in writing these articles is to offer the most effective data/perception on Colorado Actual Property that you simply can not get anyplace else! Please like and share my articles on linked in, twitter, fb, and different social media and ahead to your folks/associates I’d enormously admire it.

Glen Weinberg personally writes these weekly actual property blogs primarily based on his actual property expertise as a lender and property proprietor. He’s the proprietor of Fairview Industrial Lending. Glen has been printed as an professional in onerous cash lending, actual property valuation, financing, and varied different actual property subjects in Bloomberg, Businessweek ,the Colorado Actual Property Journal, Nationwide Affiliation of Realtors Journal, The Actual Deal actual property information, the CO Biz Journal, The Denver Submit, The Scotsman mortgage dealer information, Mortgage Skilled America and varied different nationwide publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and providers loans in Colorado which offers a singular actual property potential of what’s really taking place on the bottom each in Denver and all through Colorado. My purpose of this actual property weblog is to offer an trustworthy evaluation of what I see taking place in Colorado actual property and the way it will affect actual property house owners, consumers, realtors, mortgage professionals, and many others…

Fairview is the acknowledged chief in Colorado Arduous Cash and Colorado non-public lending specializing in residential funding properties and business properties each in Denver and all through the state. We’re the Colorado consultants having closed 1000’s of loans all through the Entrance vary, Western slope, resort communities, and all over the place in between. We additionally dwell, work, and play within the mountains all through Colorado and perceive the intricacies of every market.

If you name you’ll converse on to the choice makers and get an trustworthy reply rapidly. We’re acknowledged within the trade because the chief in Colorado onerous cash lending with no upfront charges or every other video games. Study extra about Arduous Cash Lending by way of our free Arduous Cash Information. To get began on a mortgage all we want is our easy one web page software (no upfront charges or different video games). Study find out how to discover a respected onerous cash lender and why Fairview is the finest onerous cash lender for buyers.

Tags: Denver onerous cash, Denver Colorado onerous cash lender, Colorado onerous cash, Colorado non-public lender, Denver non-public lender, Colorado ski lender, Colorado actual property developments, Colorado actual property costs, Non-public actual property loans, Arduous cash loans, Non-public actual property mortgage, Arduous cash mortgage lender, Arduous cash mortgage lender, residential onerous cash loans, business onerous cash loans, non-public mortgage lender, Arduous Cash Lender, Non-public lender, non-public actual property lender, residential onerous cash lender, business onerous cash lender, No doc actual property lender