President Trump not too long ago introduced a brand new ban on giant buyers shopping for single household properties. Sarcastically this invoice is sort of an identical to what Biden/Harris had proposed a number of years in the past. Why the curiosity in banning buyers from buying single household properties? Will this assist or damage dwelling costs? Does this new proposal take away the “flooring” below home costs?

What’s within the proposal to ban institutional dwelling consumers?

At present the main points are slim, however the proposal to ban institutional buyers possible will use the template created by Biden/Harris that was blocked in congress years again. Here’s what the final proposal was, which is probably going a very good start line of how this new ban on giant buyers will play out. There’s a query in my thoughts in the event you can outright ban an organization from proudly owning greater than x models, however the invoice could make it unprofitable for many to personal giant portions of single-family rental properties

Listed here are the important thing highlights of the prior Invoice:

- Buyers who buy greater than 50 homes can be restricted from deducting curiosity and depreciation.

- If a property is offered to a certified proprietor occupant or non revenue then curiosity and depreciation will be taken within the yr of the sale.

- Invoice applies to any property lower than 4 models. Townhomes/condos are thought of particular person models and topic to the invoice.

- The brand new laws will apply to any properties “positioned into service” after the efficient date of the signing into regulation.

Is a proposal to ban giant buyers even wanted?

I feel it’s ironic that this invoice is now being launched. Properties bought by actual property buyers noticed their largest annual decline on report within the first quarter of the yr amid falling dwelling values and excessive mortgage charges, in line with a report launched on Wednesday.

Actual property buyers bought 48.6% fewer properties within the first quarter of 2023 than they did a yr earlier as elevated rates of interest together with declining rents and housing values ate into potential income. That’s the biggest annual decline on report, and outpaced the 40.7% drop in general dwelling purchases within the main metros tracked by Redfin.

There possible can be big loopholes when banning giant buyers

The way in which the prior invoice is written there are some obvious loopholes. Somebody might arrange separate entities that max out at 50 funding single household properties. For instance, an entity might be created for Denver that holds 49 properties to get across the new regulation. It will be a ache, however corporations would do that order to avoid wasting substantial {dollars} on curiosity and depreciation.

Are giant buyers actually driving up dwelling costs?

I don’t see the deserves of how banning giant buyers will cut back dwelling costs. Many institutional buyers now are targeted on construct to hire subdivisions. Which means that a big wall avenue agency would contract with a builder to assemble floor up a for hire subdivision. This basically will increase the provision of properties within the space.

A builder is unlikely to construct a big spec subdivision with out demand. If institutional buyers are banned, builders will merely cease constructing the rise in homes for the wall avenue corporations. This can considerably lower the quantity of properties constructed which is able to finally maintain costs increased or at least about the identical.

How will this new ban on buyers affect what occurred within the final recession

Within the final recession home costs plummeted. Buyers got here in and purchased in bulk giant swimming pools of homes. For instance if a builder went bust, a financial institution would find yourself with a complete subdivision and would promote this off to buyers. Sarcastically many of those gross sales had been made by the FDIC when banks failed. It was best to do away with these loans in bulk versus individually as a result of carrying prices, and so forth… When there’s one other financial downturn, there is not going to be consumers which might be keen to take the homes in bulk from the FDIC which is able to create additional issues when home costs reset. Taxpayers will then in flip take up these losses.

Will this new ban on buyers have the meant results of decrease home costs?

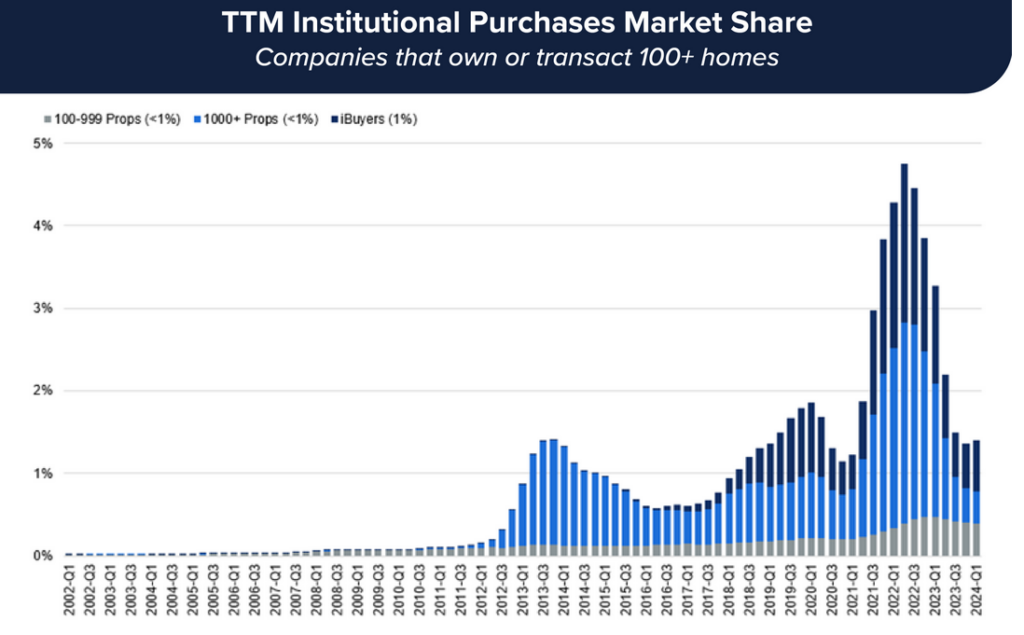

Completely not. There may be this idea that institutional buyers are someway distorting the one household dwelling market. At present, institutional buyers solely personal about 0.2 p.c of all single-family properties, and simply one-percent of rental properties, in line with current knowledge introduced to the U.S. Senate by The Heritage Basis. The Heritage Basis additionally identified that in no state, do institutional buyers personal greater than 1 in 100 of all out there housing.

“‘Institutional homeowners’ of rental properties are being scapegoated for the rise in dwelling costs and rental prices,” Joel Griffith, a analysis fellow defined. “…The underside line is that institutional SFR possession just isn’t measurably impacting native dwelling worth dynamics to the upside.”

Large unintended penalties of banning giant buyers

Though the intention of the invoice is to decrease costs for different householders to purchase properties, the unintended penalties of this laws could have the alternative impact.

- Much less provide: Many giant institutional buyers are actually constructing “for hire” subdivisions which is drastically rising the provision of leases in lots of markets. With the brand new laws, these tasks is not going to be economically possible resulting in a big drop in provide. As provide drops, costs will rise for each leases and houses on the market.

- Enable costs to fall additional in downturn: We’ve seen in prior downturns that institutional buyers put a “flooring” on how a lot costs might fall. Institutional buyers had been the biggest purchasers of defaulted notes and properties. When there’s a repeat of 2008, the market will fall significantly extra if there should not deep pocketed consumers keen to step in. Think about if each property held by the FDIC or the Fannie Mae, and so forth… might solely be offered to a person proprietor or a really small investor. It will take 3-5 years to do away with all of the properties resulting in a a lot worse consequence and slower restoration.

- Slippery slope on enterprise funding: The entire premise of concentrating on one particular sort of purchaser in a selected trade could be very regarding. What occurs if subsequent they are saying that you could’t depreciate flats or industrial properties or any myriad of different enterprise belongings. This proposal goes down a really slippery slope that may have far-reaching ramifications for future enterprise funding.

- Transfer investments to flats: The proposal to ban giant buyers will shift demand to the condo market and remove many single household company leases. For instance, as an alternative of constructing a indifferent single-family neighborhood, they may construct connected properties which might be “flats” and never coated below the regulation. This can remove the flexibility for a lot of decrease revenue households to stay in a single-family dwelling.

What has brought on the large rise in costs?

It’s attention-grabbing that buyers are being scapegoated for the large rise in costs as the true offender is rates of interest & construct prices. As rates of interest had been pushed to historic lows throughout the pandemic it created ripe circumstances to make use of extremely low-cost leverage to make hefty returns on actual property. It wasn’t simply institutional buyers that benefited as people and smaller buyers additionally took benefit of the ultra-low charges to purchase a second dwelling, or improve to a bigger dwelling, and so forth… The large demand for actual property was pushed by the as soon as in a lifetime low charges. This in flip pushed up actual property costs and in flip rents.

Construct prices have additionally skyrocketed all through the nation as a result of authorities regulation, labor prices, land prices, materials prices, and so forth… which makes it unprofitable to construct many properties at lower cost factors the place there’s probably the most demand as it’s not worthwhile. The rise in construct prices is not going to go away particularly in lots of excessive price areas like Denver that simply elevated the minimal wage to nearly $20/hour and proceed so as to add “inexperienced constructing” necessities that considerably improve the prices from an all-electric dwelling to vitality effectivity requirements. Every merchandise prices cash and if you couple this with elevated materials and labor prices, the numbers can not work for constructing price efficient properties.

Banning institutional buyers hurts the market long run

This new proposal to focus on giant buyers is not going to have the meant impact of decrease costs. The ban on giant buyers will do the alternative and lift costs over the long run as a result of a discount in stock/funding in single household leases. Moreover, this proposal creates a slippery slope and opens up pandora’s field on who might be the following goal. This can finally result in much less funding and even decrease stock, furthering worth will increase and hire will increase.

The true resolution is to let the markets work as meant with rising provide and fewer authorities subsidization of ultra-low charges. The ban on giant buyers is the fallacious resolution because the market is already resolving itself with out this invoice. We’re already seeing this occur in actual time with buyers slicing their purchases as charges have risen. Even with the discount in investor purchases costs should not falling in most markets as the true offender continues to be the lock in impact of ultra-low rates of interest and very excessive prices to construct new homes as a result of authorities laws.

Extra Studying/Assets

- Trump says U.S. to ban giant buyers from shopping for properties

- Trump Proposal on Housing Would Not Make It Extra Reasonably priced – Bloomberg

- https://www.banking.senate.gov/imo/media/doc/stop_predatory_investing_act_one_pager.pdf

- https://www.banking.senate.gov/imo/media/doc/stop_predatory_investing_act1.pdf

- https://thehill.com/enterprise/4091602-senate-democrats-take-aim-at-investor-home-purchases/

- https://information.theregistryps.com/as-institutional-investors-buy-up-single-family-homes-everyday-americans-must-sprint-to-catch-the-american-dreampercentEFpercentBFpercentBC/

- https://www.fairviewlending.com/new-senate-bill-predatory-investing-to-curb-corporate-investors-from-buying-up-single-family-homes/

- https://coloradohardmoney.com/weblog/

We’re a Personal/ Arduous Cash Lender funding in money!

In the event you had been forwarded this message, please subscribe to our weekly e-newsletter to remain on high of reports that strikes actual property markets

I want your assist! Don’t fear, I’m not asking you to wire cash to your long-lost cousin that’s going to offer you one million {dollars} in the event you simply ship them your checking account! I do want your assist although, please like and share our articles on linkedin, twitter, fb, and different social media and ahead to your pals 😊. I might drastically admire it.

Written by Glen Weinberg, COO/ VP Fairview Business Lending. Glen has been printed as an skilled in onerous cash lending, actual property valuation, financing, and numerous different actual property subjects in Bloomberg, Businessweek ,the Colorado Actual Property Journal, Nationwide Affiliation of Realtors Journal, The Actual Deal actual property information, the CO Biz Journal, The Denver Put up, The Scotsman mortgage dealer information, Mortgage Skilled America and numerous different nationwide publications.

Fairview is a onerous cash lender specializing in non-public cash loans / non-bank actual property loans in Georgia, Colorado, and Florida. We’re acknowledged within the trade because the chief in onerous cash lending/ Personal Lending with no upfront charges or some other video games. We fund our personal loans and supply sincere solutions rapidly. Study extra about Arduous Cash Lending by way of our free Arduous Cash Information. To get began on a mortgage all we’d like is our easy one web page software (no upfront charges or different video games).

Tags: Arduous Cash Lender, Personal lender, Denver onerous cash, Georgia onerous cash, Colorado onerous cash, Atlanta onerous cash, Florida onerous cash, Colorado non-public lender, Georgia non-public lender, Personal actual property loans, Arduous cash loans, Personal actual property mortgage, Arduous cash mortgage lender