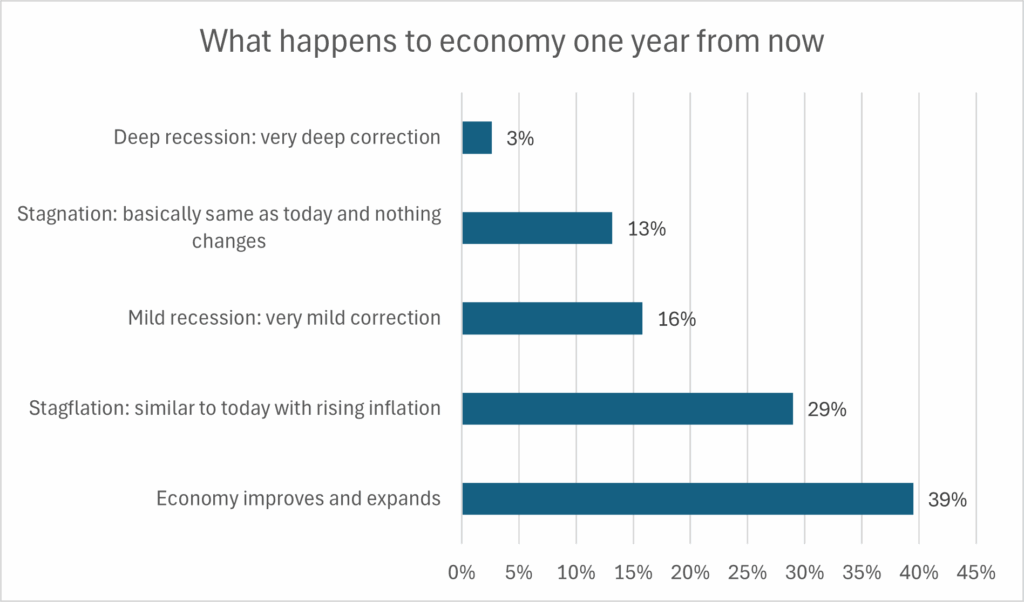

Final week in my weblog, Heavy vans sign a recession, I requested all of you what occurs to the financial system one yr from now? I used to be floored by the response. The actual property professionals have spoken and as you possibly can see from the chart above, the bulk (39%) suppose the financial system goes to enhance/increase from right here. How correct are these predictions? What was the rationale behind the bettering financial system.

What did actual property professionals say concerning the financial system one yr from now?

I used to be fairly stunned on the responses. My predictions is that the financial system expands and a deep recession can be about equal (lower than 5%). I used to be completely flawed, based mostly on the survey the bulk thought that the financial system would increase. It is very important take this can a little bit grain of salt as 45% thought that the financial system would keep the identical or enter a stagflationary atmosphere. My intestine is that one in all these two situations will play out and I’m not as optimistic on an expansive financial system, however I positively may very well be flawed particularly based mostly on the rationale given within the feedback beneath.

Key insights into what’s going to occur to the financial system in a single yr

Listed here are among the key feedback that had been talked about when answering the survey on the financial system:

- Inflation and rates of interest are bettering and Trump insurance policies ought to begin to flip financial system

- Effectivity revolution and infrastructure/manufacturing facility investments.

- The mortgage charges will get lowered when Powell leaves and the housing market will develop into vibrant once more.

- The huge capital funding—each private and non-private sector—is immense. The continued discount of rules and the lighter contact on taxes federally are driving customers and small companies. Healthcare is a serious contributor to inflation and financial dysfunction nonetheless.

- I believe the financial system hits a interval of rising inflation on the identical time the financial system stagnates a bit. The inventory market is overvalued and as soon as that stops we’ll see the financial system principally stand nonetheless

- Shopper confidence is declining. Small companies gross sales are flat. CRE workplace mortgage defaults are rising. AI hype is driving fairness values. Fed shutdown is constant. SFR gross sales decline accelerating.

Key takeaways on the place the financial system goes from right here

Thanks everybody in your participation and insights in my survey. The perception within the feedback from readers was superb and as you possibly can see there are very completely different/polarizing ideas on the financial system. My key takeaway from this survey is that we don’t actually know what will occur, however my finest guess is that we’re principally caught. On the flip facet, as many readers highlighted within the feedback we’re seeing a revolution in know-how that would drastically alter the financial system with increased effectivity resulting in an upside shock. Lengthy and quick we should wait and see how this all shakes out. Thanks once more and keep tuned for upcoming surveys

Further Studying/Assets:

- https://www.fairviewlending.com/trucks-signal-a-recession-my-data-says-opposite/

- https://www.fairviewlending.com/fed-drops-rates-why-did-mortgage-rates-barely-budge/

- https://www.fairviewlending.com/phantom-debt-soars-what-does-this-mean-for-real-estate-2/

- https://www.fairviewlending.com/never-buy-a-residential-condo/

- https://www.fairviewlending.com/the-war-on-landlords/

- https://www.fairviewlending.com/house-prices-hit-another-record-should-you-even-care/

- https://www.fairviewlending.com/root-cause-of-real-estate-price-declines/

- https://www.fairviewlending.com/will-real-estate-fall-to-2020-values/

We’re a Non-public/ Onerous Cash Lender funding in money!

Glen Weinberg personally writes these weekly actual property blogs based mostly on his actual property expertise as a lender and property proprietor. I’m not an armchair reporter/author. We’re an precise personal lender, lending our personal cash. We service our personal loans and personal industrial and residential actual property all through the nation.

My day job is and continues to be personal actual property lending/ laborious cash lending which permits me to have a novel perspective in the marketplace. I don’t settle for any paid sponsorships or advertisements on my weblog to make sure correct data. I’ve been scripting this for nearly 20 years and have over 30k subscribers. Please like and share my blogs on linkedin, twitter, fb, and different social media and ahead to your mates . I’d enormously admire it.

Fairview is a laborious cash lender specializing in personal cash loans / non-bank actual property loans in Georgia, Colorado, and Florida. We’re acknowledged within the business because the chief in laborious cash lending/ Non-public Lending with no upfront charges or another video games. We fund our personal loans and supply sincere solutions rapidly. Study extra about Onerous Cash Lending by means of our free Onerous Cash Information. To get began on a mortgage all we’d like is our easy one web page software (no upfront charges or different video games).

Written by Glen Weinberg, COO/ VP Fairview Business Lending. Glen has been revealed as an skilled in laborious cash lending, actual property valuation, financing, and varied different actual property matters in Bloomberg, Businessweek ,the Colorado Actual Property Journal, Nationwide Affiliation of Realtors Journal, The Actual Deal actual property information, the CO Biz Journal, The Denver Put up, The Scotsman mortgage dealer information, Mortgage Skilled America and varied different nationwide publications.

Tags: Onerous Cash Lender, Non-public lender, Denver laborious cash, Georgia laborious cash, Colorado laborious cash, Atlanta laborious cash, Florida laborious cash, Colorado personal lender, Georgia personal lender, Non-public actual property loans, Onerous cash loans, Non-public actual property mortgage, Onerous cash mortgage lender, residential laborious cash loans, industrial laborious cash loans, personal mortgage lender, personal actual property lender, residential laborious cash lender, industrial laborious cash lender, No doc actual property lender